As we foresee more bearish potential on this pair based on our previous write up on technical analysis, we think the current upswings are just momentary but expect our next immediate targets at 1.4949 1st and 1.4525 levels upon breach of 1st target. The huge profits achievable with the strip strategy when EURCAD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

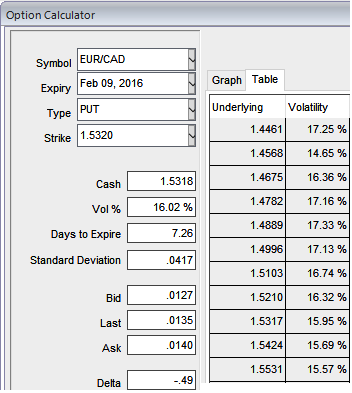

Weights are to be more to cushion downside risks as a result, we recommend holding 15D at-the-money 0.51 delta call and simultaneously hold 2 lot of 1M at-the-money -0.49 delta put options.

The rationale: Any potential downswings should be optimally utilized, so as to participate in that downtrend, weights in the portfolio should be doubled with ATM puts in order to give the leveraging effects. The profitability can be maximized for every shift towards downside and this is not the same on upside.

What makes ATM instrument more productive in our strategy and delta effects: Please be noted that The implied volatility of 1W ATM puts show 16%, so there is high probability of EURCAD's dips.

The delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options. A higher absolute delta value is desirable for an option buyer.

When ATM instruments have the healthy gamma, vega, and theta that means their premiums are the most sensitive to moves in either direction. The Delta of ATM put options are 50% and IVs are 16% which means there is a likelihood of expiring our ATM option ITM.

Accelerate profitability: Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: EUR/CAD 1W ATM IVs at 16% - Why to deploy ATM delta instruments in EUR/CAD option strips

Tuesday, February 2, 2016 10:30 AM UTC

Editor's Picks

- Market Data

Most Popular