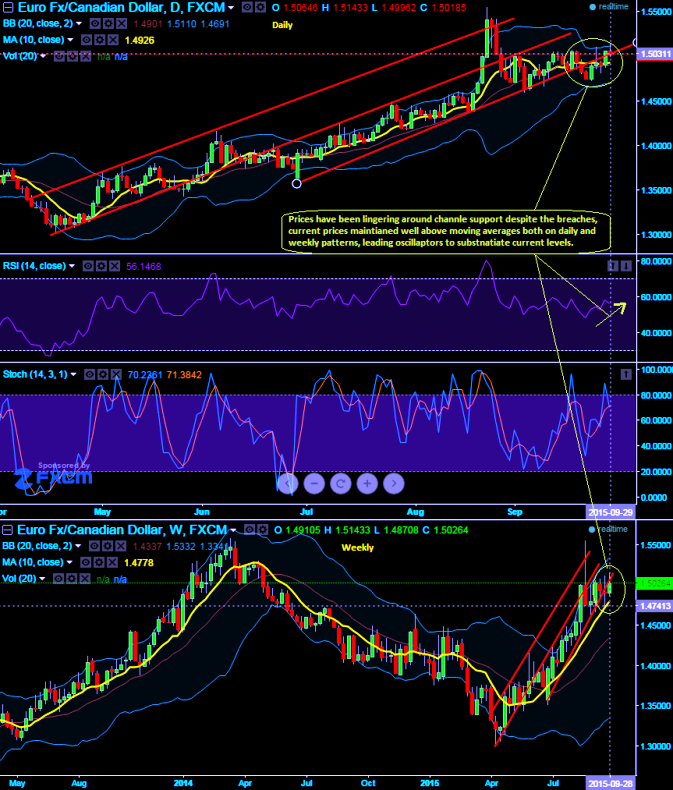

We don't foresee any sort of weakness in this pair as the uptrend seems quite healthy in our opinion with timely and right corrections every now and then. More importantly, there is no trace of bearish signals by any indicators in all daily, weekly and monthly graphs. RSI and stochastic curves are positively converging with price spikes, while prevailing price has been maintaining its level well above moving average curve that signify the current uptrend to prolong.

Any skepticism on Canadian dollar's further depreciation against euro should certainly be covered with "Option Straps Strategy" as it took support at lower channel line and is now heading towards our earlier targets at 1.5252 levels which would be the channel line distance, The calls on option straps strategy are meant for hedging grounds with accurate timing, then covers your underlying currency exposures regardless of directions.

Those who've missed it, no regrets can still add fresh positions at this level as well. The recommendation goes this way, buy 15D At-The-Money delta put option and simultaneously buy 2 lots of 15D At-The-Money delta call options, one can still build the same at this juncture with an objective to achieve above targets of 1.5252. The strap is more of customized edition of combination and more bullish version of the common straddle. Regardless of the swings from here on would derive positive cash flows but more movement required on downside in order to have positive cash flows.

Hence, any hedger or trader who believes EURCAD is more likely to surge upside up to or even above our targets of 1.5252 can go for this strategy. Maximum returns can be achievable when the underlying exchange rate makes a strong move either upwards or downwards at expiration but with greater gains to be made with an upward move. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

FxWirePro: EUR/CAD uptrend seems intact, drifting around channel line despite breach – straps serve hedging objectives

Tuesday, September 29, 2015 1:35 PM UTC

Editor's Picks

- Market Data

Most Popular