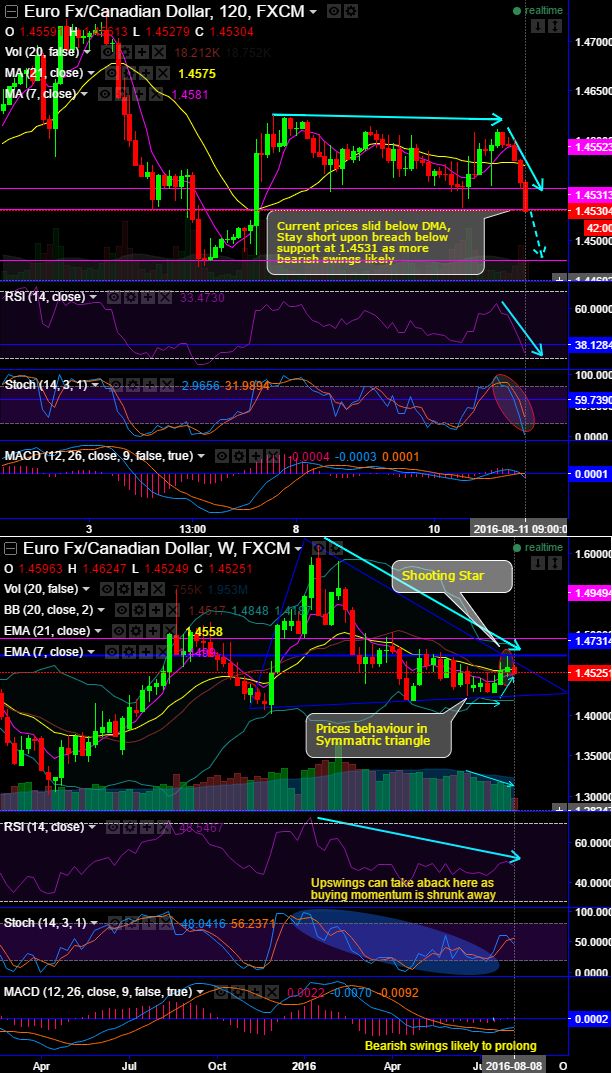

The current prices have slid below 7SMA and 21SMA, now broken 1.4531 levels with intensified selling interest in this pair.

A “shooting star” pattern candle formed at peaks of 1.4598 levels on weekly plotting to highlight a caution for bulls. As a result, ever since then you can observe corresponding price drops in intraday charts.

On both intraday day (2H) and weekly charts of EURCAD we spot out prices moving in sync with indications of one another.

These bearish swings have been slipping through a symmetric triangle pattern, testing 7EMAs and sloping line of the triangle as a stiff resistance.

In addition to that, leading oscillators (2H charts) are showing downward convergence with the price dips on intraday and weekly chart.

RSI looks healthily converging with every price declines below 33 levels; RSI signifies the same stance no deviation even on the weekly graph, so the prevailing down streaks may sustain for some more slumps in the weeks to come.

While another leading oscillator (slow stochastic) hints us the overbought heaviness through %D crossover at 35 levels, so the bears don’t seem to lose this momentum atleast in near term built by healthy volumes.

FX Option Trade Tips:

Hence, at spot ref: 1.4530 (while articulating) we advocate one touch binary puts for intraday speculators in an on-going bearish environment that is likely to fetch certain yields.

Alternatively, using any abrupt rallies, you decide to initiate a diagonal bear put spread at net debit 1w ATM IVs of EURCAD is just shy above 7.4%, and likely to spike higher 8% in 1m tenor.

The execution: Initiate shorts in 1W (1%) out the money put with positive theta, simultaneously, buy 1M in the money -0.5 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.