Do you have concern over non-directional trend and lacklustre implied volatilities, then here is the beast option strategy to tackle both ways.

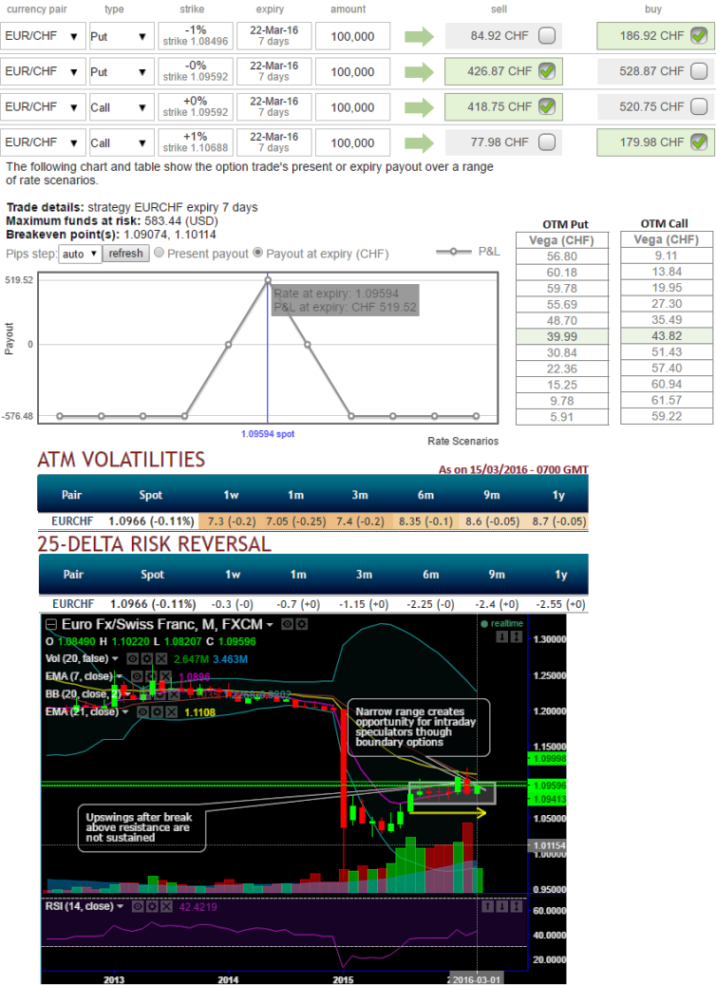

ATM IVs of 1W expiries are reducing to 7.3%, and 7.05% for 1m tenors.

Have a glance over technical charts, you would be convinced with absolutely non-directional trend moving in linear curve.

Nevertheless, we can still extract returns from this pair even though exhausted bulls to take halt at this point have slip back into range. Yes, that’s quite achievable from iron butterfly strategy.

To execute this strategy, the hedger goes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

At current spot FX around 1.0960 levels, Iron Butterfly spread of EURCHF could be executed in following way:

Long (1%) OTM strike -0.17 delta Put & Short ATM strike Put + Short ATM Call & Long (1%) OTM strike 0.20 delta call

Vega on Long 1% OTM call = 43.82

Vega on Long 1% OTM put = 39.99

Usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case Vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of EURCHF to remain near short strikes in order to achieve highest returns.

Maximum returns for this strategy is achievable when the underlying spot FX at expiration is equal to the strike price at which the call and put options were short.

At this juncture on expiration, entire positions go worthless and you can get to pocket in the entire net credit received.

FxWirePro: EUR/CHF IVs least among G10 space, vega suggests long iron butterfly for both speculating and hedging

Tuesday, March 15, 2016 11:28 AM UTC

Editor's Picks

- Market Data

Most Popular