We believe Euro's spot FX has been overreacting after the ECB's decision to cut the deposit rates by 10 bps to -0.30% from minus 0.2% are cushioning a bit, while expectations were minimum 15-20 bps, so we think this as rather a disappointing for some set of market participants.

ECB left its key lending rate unchanged at a historically low level of 0.05% which is as per the expectation.

The asset purchase programme (APP) will continue for longer, until March 2017 at least, but at a steady pace of €60bn a month.

In a true smile, options with an at the money strike are priced with a lower volatility than out of the money and in the money volatility strikes.

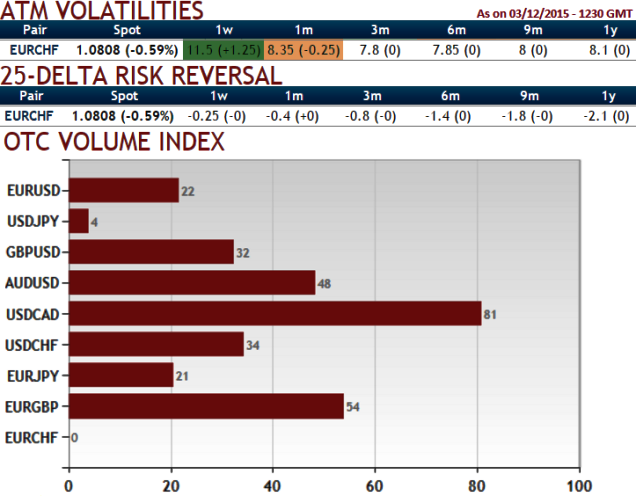

Such market occurrences are observable in the EURCHF FX OTC market (see IVs of ATM contracts with 1-3M expiry).

Almost 1.32% jump from yesterday's lows to highs, but if you see the OTC volumes it seems hedgers have been well positioned for next 1-3m considering delta risk reversal negative numbers which is in line with moderately downtrend.

For instance, suppose we've constructed an at the money put option of EURCHF with near month expiries and with given maturities implied volatility has been around 8.26%, and that its delta amounts close to 54%.

We ponder now with an another put option with the same maturity with an implied volatility creeping up at 8.36% but its strike is 1% in the money (strike at 1.0830) and while its delta is just shy of 70%.

Furthermore, let's contemplate a 3rd option with a strike out of the money strike (1%) and a delta of 30% is also priced with a volatility of 8.68%.

Now just have a glance on delta risk reversal table that signifying hedging activities for downside risks are piling up. As a result ATM puts look more costlier.

We have positioned for lower EUR/CHF in options with a risk reversal but the medium tenor (1m-3m expiring Dec 2015 or so).

FxWirePro: EUR/CHF bears poised with over-reactive spot FX rallies – OTC well balanced

Friday, December 4, 2015 6:56 AM UTC

Editor's Picks

- Market Data

Most Popular