Switzerland trade surplus decreased to CHF 3.14 billion in November of 2015 from CHF 3.75 billion a year earlier and missing market consensus, as imports rose more than exports.

Switzerland recorded a current account surplus of CHF 23 billion in the three months to September of 2015, compared to a CHF 12 billion surplus a year earlier and the highest since the second quarter of 2013.

The widening was mainly due to higher surpluses on investment income (up by CHF 8 billion to CHF 12 billion) and goods (up by CHF 5 billion to CHF 15 billion) while services surplus decreased slightly (to CHF 4 billion from CHF 3.7 billion) and the surplus of secondary income remained stable at CHF 3 billion.

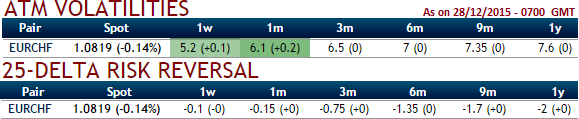

On a 1-3m horizon, our target for this pair is still higher though we have adjusted our Q1 2016 forecast (at 1.10). There onwards trimming of these gains are on the cards which would pull back towards 1.08 levels in next 3-6 months' time frame, one can also have a glance on delta risk reversal nutshell as to know how the OTC markets are positioned towards such bearish anticipation in long run.

The latest quarterly SNB meeting did nothing to fundamentally change the outlook. The inflation forecast was revised lower again in the near-term (on lower energy prices) though the long-term forecast was little changed.

Although EUR/CHF reached a new post-floor high in the beginning September (at 1.1049), the pace of appreciation is painfully slow, Infact the fluctuation has been softened. But we do not expect that to change. We have fairly positioned for higher EUR/CHF in options with a risk reversal but the long tenor (1y at entry, expiring July 2016) shows how long we expect this process to take.

Technically there is a reasonably well-defined rising trend line for EUR/CHF, dating back to the start of the current move higher in July. Support comes in at 1.0880 - that also coincides with the 21 DMA. A break through there may set us up for a short-term retracement. We would view that as a buying opportunity for EUR/CHF.

FxWirePro: EUR/CHF factors in Swiss trade balance and current a/c surplus, forecasts for Q1 2016 still edging higher

Monday, December 28, 2015 11:14 AM UTC

Editor's Picks

- Market Data

Most Popular