We spot on the pair that has the least ATM IVs when the underlying spot FX has also been drifting in range bounded trend. We upgraded our CHF forecasts. Those envisaged a gradual but strictly bounded rise in EURCHF to 1.20 as the capital account recycling of Switzerland’s still massive current account surplus (10% of GDP, 3x the Euro area’s surplus) was expected to be temporarily assisted by a range of second-order, pent-up capital outflows from Switzerland as EUR-centric risk subsided.

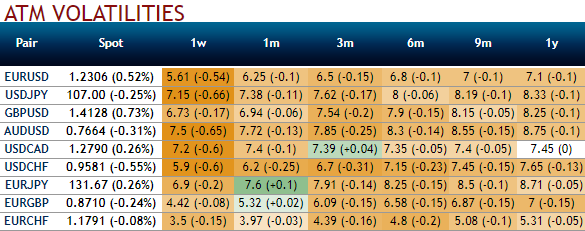

Well, let’s just glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite this week’s data announcements such as, German CPI, Euro area trade balance and ECB’s Draghi’s speech which is quite significant. These lower volatile conditions are conducive for the option writers.

The persistent euro strength should nudge EURCHF higher but not significantly as technical analysis signal lingering bearish strength in the near term. As a result, chances of calls being priced exorbitantly.

Please observe that the major trend has been drifting in the tight range of 1.1830 and 1.1466 levels (refer rectangular area in daily technical chart). As a result, we recommend below option strategies using right instruments, thereby, one can benefit in this low volatile conditions.

Iron condor spreads:

The implied volatility is a tad below 4% in 1m tenors along with bearish neutral risk reversal sentiments, accordingly, we construct multiple legs of option strategy for regular traders of this currency cross when there is little IV.

EURCHF's lower IVs with bullish neutral delta risk reversals could be interpreted as the option writer’s opportunity in short run. Thus, exploiting on lower IVs we eye on shorting calls with shorter expiries which would lock in certain yields by initial receipts of premiums.

A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

As shown in the diagram, one can execute this strategy using options expiring on the same expiration month, the options trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This is likely to result in a net credit to put on the trade.

The above nutshell indicates how the option's premium value (NPV) is affected with respect to changes in the underline currency rate. It will also show your exposures (Delta, Gamma, Vega, and Theta) change with respect to changes in the underline currency rate. This report is in Beta.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 18 levels (which is neutral), while hourly CHF spot index was at a tad below -39 (bearish) while articulating (at 11:17 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

These currency indices are conducive to the above-mentioned options strategy.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures