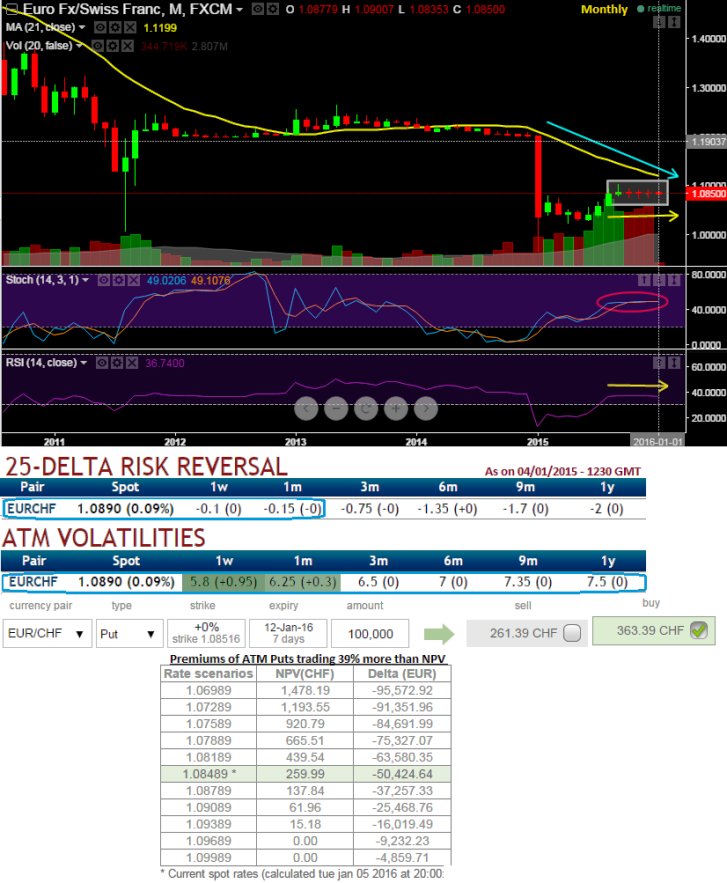

Vols and risk reversal: Based on order flow analysis, the low implied volatility is also experienced from last couple of days and would likely to perceive the lower side for next 2-3 months or so as shown in the nutshell.

While delta risk reversal indicates bearish hedging activities have been piling up and it would remain the same for 3-6 months or so. As a result ATM puts are priced in costlier.

Daily technicals suggest lackluster movements (see grey shaded areas for range-bounded zone, historically when thee is an anticipation of narrow range, this has never disappointed) but slightly bearish bias after a formation of shooting star at peaks of 1.0875 levels.

While leading indicators moving in linear direction, no divergence to this range bounded trend. But more notably you figure out a huge volume confirms these trivial bearish swings to prolong.

As the risk appetite differs from diverse investors to various traders, we have customized our formulation of strategies for such varied circumstances.

Thus, short 2% OTM call and short one more -1.5% OTM put of the same maturity for net credit. The OTM strikes should be selected so as to meet out the above specified bands on both the sides. Select the strikes to match the above mentioned price bands.

Rationale: Since the range bounded market is evidenced and the continuation is suggested by technicals and lower implied volatility at 5-7% in next 6 months to substantiate this reasoning, we recommend taking the advantage of these benefits through above option trading strategy.

This strategy derives limited returns with unlimited risk that is taken when the options trader thinks that the EURCHF would experience little volatility in the near term.

FxWirePro: EUR/CHF option trading set up - short strangles ensure certain yields in range-bound trend

Wednesday, January 6, 2016 6:05 AM UTC

Editor's Picks

- Market Data

Most Popular