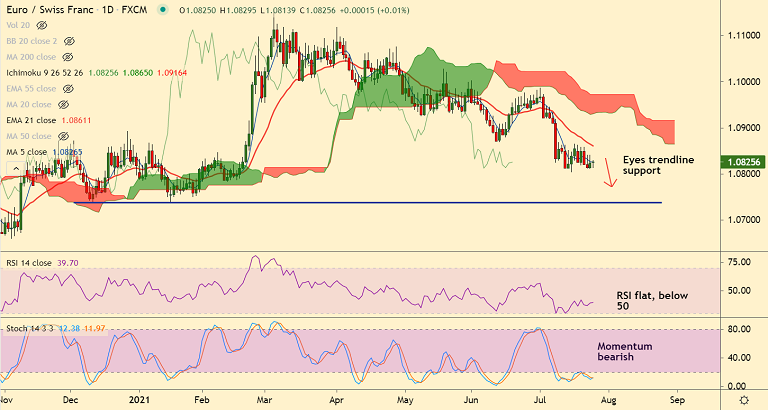

EUR/CHF chart - Trading View

EUR/CHF has edged higher from session lows and was trading largely unchanged at 1.0825 at around 11:10 GMT.

The pair is on a downtrend from multi-month high at 1.1151 (March 4th) and bias remains bearish.

Price hit session lows after data released earlier on Monday showed German IFO Business Climate Index unexpectedly drops in July.

The headline German IFO Business Climate Index unexpectedly fell to 100.8 in July, missing consensus estimates of 102.1 versus last month's 101.7.

The Current Economic Assessment printed at 100.4 points in as compared to last month's 99.7 and lower than 101.6 expected.

Further, the IFO Expectations Index dropped sharply to 101.2 in July from the previous month’s 103.7 reading and the market expectations of 103.3.

Technical indicators are biased lower. The pair is poised for further downside. Scope for test of trendline support at 1.0735.