Many analysts struggled to interpret the EUR strength seen over the past days. The German GDP data on Tuesday was at best the trigger of the move but hardly the reason or the fundamental justification.

However, one also has to realize that many market participants are likely to find the euro attractive. Of course, there is not going to be an ECB rate hike next year either. The European central bankers have made that sufficiently clear by extending the QE program.

Stay long EURGBP call spread:

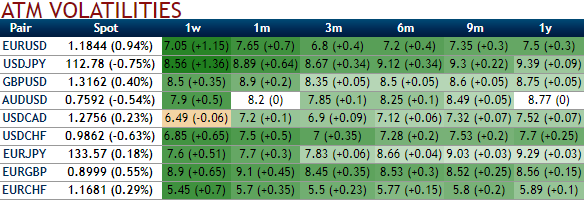

The implied volatility of ATM contracts for near month expiries of EURGBP is spiking at around 9.1-8.45% for 1-3m tenors, while positively skewed EURGBP IVs appears to be conducive for call option holders as the delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks over the period of time.

Hence, considering above OTC market reasoning and fundamental factors we think upside risks are on the cards, as result we reckon deploying ATM call option with delta being at around +0.51 in hedging strategies are worthwhile.

There is little to report from the UK this week. Activity data has been mixed this week (strong IP, firmer than expected pay growth, but certain indicators suggesting weak retail sales growth).

We continue to think that this is not a particularly bullish backdrop for GBP, irrespective of the recent increase in interest rates and maintain the bearish view although admittedly GBP remains subject to the data flow in the coming weeks.

In addition, the long EUR exposure from this trade serves as a hedge to our short EUR positions elsewhere in the portfolio (via CHF).

Long a 2m 0.8950 - 0.9150 EURGBP call spread. Paid 52bp September 29th.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data