- Weakness seen in the single currency ahead of German ZEW economic sentiment index.

- EUR/GBP slips below the 0.7700 handle, finds support near 0.7665-60 area. Break below would see further downside towards 0.76 levels.

- The pair trades with a major bearish bias on the weekly and monthly charts, pullbacks should be looked as selling opportunities.

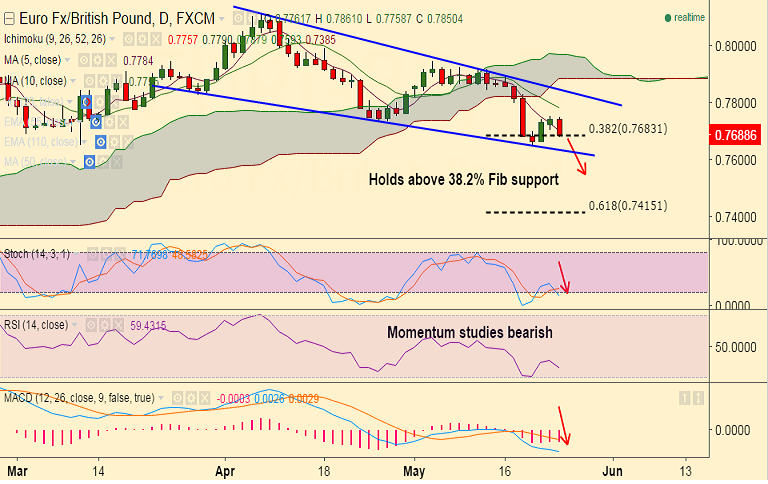

- On the dailies the pair has broken below 5-DMA at 0.7702, but holds 38.2% Fib level support at 0.7683.

- Weak German sentiment data could see slump in the pair. Support for remain vote in 'Brexit' coupled with improvement in the UK economic data, had been a supportive for the Pound.

Recommendation: Good to go short on break below 0.7683, target 0.7650/0.76/0.7550