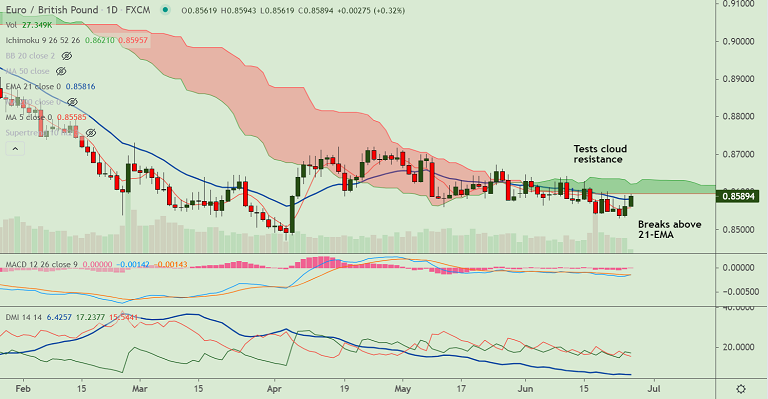

EUR/GBP chart - Trading View

- EUR/GBP was trading 0.34% higher on the day at 0.8590 at around 08:05 GMT, pound extends BOE-led losses.

- Sterling keeps the lower ground after the Bank of England (BOE) left interest rates and a bond-buying program unchanged, as widely expected in its June meeting.

- The central bank policymakers’ inability to provide hawkish outlook weighed down the pound on Thursday, pushing the pair higher.

- BoE statement said "The Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably."

- MPC members refrained from voting any policy change. Focus now on BOE quarterly bulletin to reconfirm policymakers’ bearish bias.

- On the data front, the UK Gfk Consumer Confidence stood at -9 in June, unchanged from the previous month. The data failed to trigger much buying interest in the pound.

Summary:

Technical bias on the intraday charts is turning bullish. Price action has edged above 200H MA. Focus on UK CBI Distributive Trade for June for further impetus.