- The single currency buoyed after upbeat German IFO business climate index for the month of September.

- German IFO business climate for September stood at 109.5, which was better than 106.3 expected and 106.2 recorded in August.

- EUR/GBP extended Friday's strong momentum after German IFO business climate data.

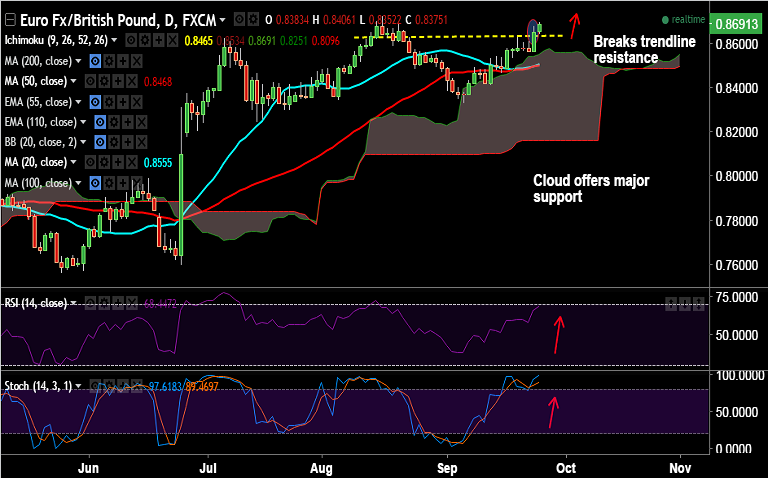

- The pair has broken major trendline resistance at 0.8635, we see scope for further upside.

- Next major resistance seen at 0.8725 (Aug 16 high) ahead of 0.88 (trendline resistance).

- Daily cloud offers major support on the downside, break below could see test of next major support at 0.85 (converged 50 & 20 DMAs).

- Violation there could see downside resume, could see weakness upto 0.8325 (trendline).

Recommendation: Good to go long on dips around 0.8670, SL: 0.8640, TP: 0.8724/ 0.88