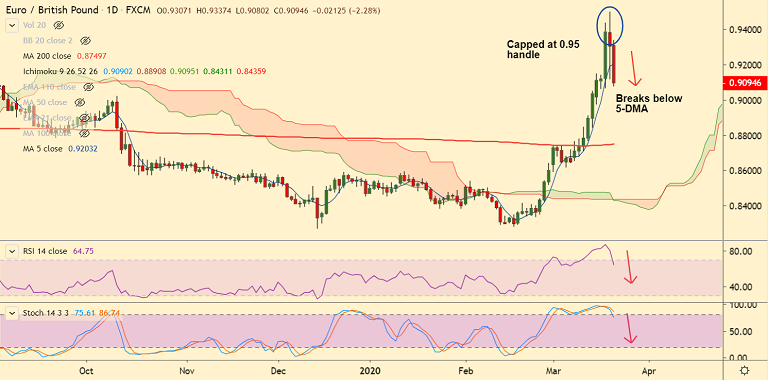

EUR/GBP chart - Trading View

EUR/GBP is extending weakness for the 2nd straight session after bulls failed to takeout 0.95 handle.

The pair was trading 1.95% lower on the day at 0.9123 at around 10:00 GMT, extending previous session's 0.82% drop.

Euro dampened after the ECB announced a €750 billion QE programme late on Wednesday, expected to run at least until year-end.

Poor data which showed preliminary German IFO Business Climate dropped to 87.7 for the month of March, the lowest level since August 2009 added to the downside pressure.

Also, data released earlier today showed Eurozone Current Account surplus widened to €34.7 billion during January.

The pair has retraced below 5-DMA and is on track to test 200H MA at 0.9018.

Stochs and RSI have rolled over from overbought levels and break below 200H MA will plummet prices further.

Next major support lies at 21-EMA at 0.8859. Failure to close below 5-DMA negates bearish bias.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics