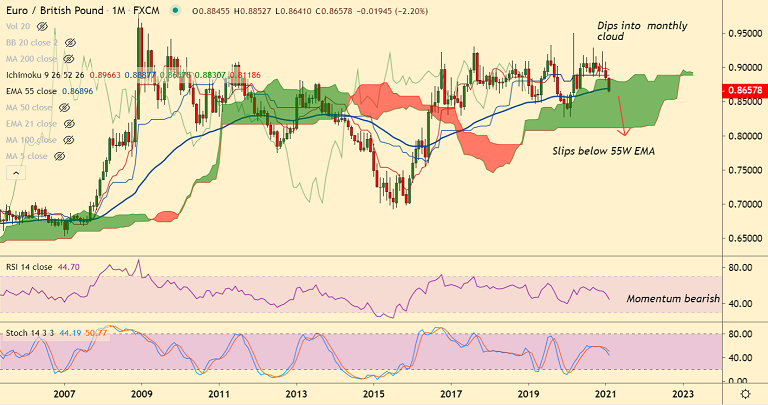

EUR/GBP chart - Trading View

EUR/GBP consolidates losses after testing 11-month lows, trades marginally higher at 0.8660, outlook remains bearish.

The pair hit lows of 0.8641 on Thursday's trade, levels unseen since March 5th 2020, before paring some losses to close at 0.8648.

Focus for today is on the German and Eurozone PMIs later today. Poor data could add selling pressure on the shared currency.

Analysts expect PMIs could miss estimates on account of ongoing coronavirus lockdown restrictions.

Markit economics' flash Manufacturing Purchasing Managers Index (PMI) for Germany is seen dropping to 56.5 in February from January's 57.1.

While Eurozone PMI is forecast to decline to 54.4 in February from January's 54.8.

Technical bias for the pair is strongly bearish. price action has slipped below 55W EMA support at 0.8689.

The pair is on track to test 78.6% Fib retracement at 0.8559. Failure to close below 55W EMA could see further consolidation.