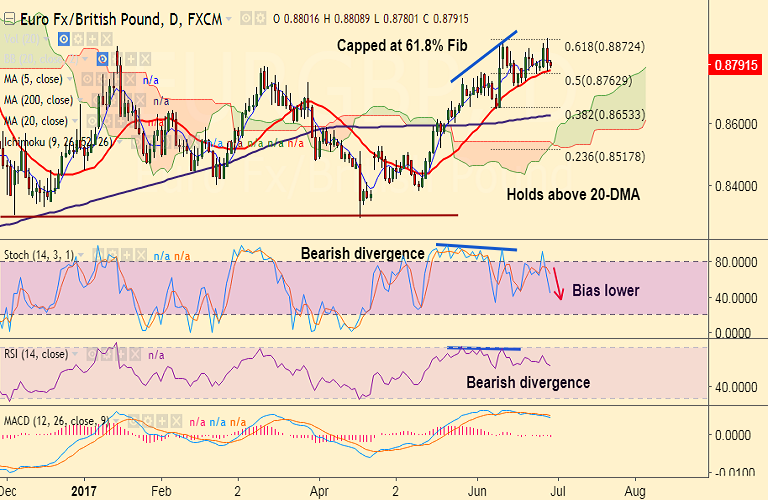

- EUR/GBP is trading in a narrow range, remains capped no the upside by 5-DMA and holds 20-DMA support on the downside.

- Technical indicators are slightly bearish, RSI and stochs are biased lower.

- Bearish divergence on RSI and Stochs raises scope for downside.

- Break below 20-DMA support at 0.8757, raises scope then for test of 0.8651 (38.2% Fib of 0.92253 to 0.8297 fall).

- Violation at 38.2% Fib will see test of 200-DMA at 0.8622.

- Bearish invalidation on break above 61.8% Fib retrace of 0.92253 to 0.8297 fall at 0.8870.

Support levels - 0.8774 (20-DMA), 0.8719 (June 16 low), 0.8651 (38.2% Fib of 0.92253 to 0.8297 fall)

Resistance levels - 0.8806 (5-DMA), 0.8845 (June 21 high), 0.8870 (61.8% Fib)

Recommendation: We prefer to wait for clear directional bias.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.