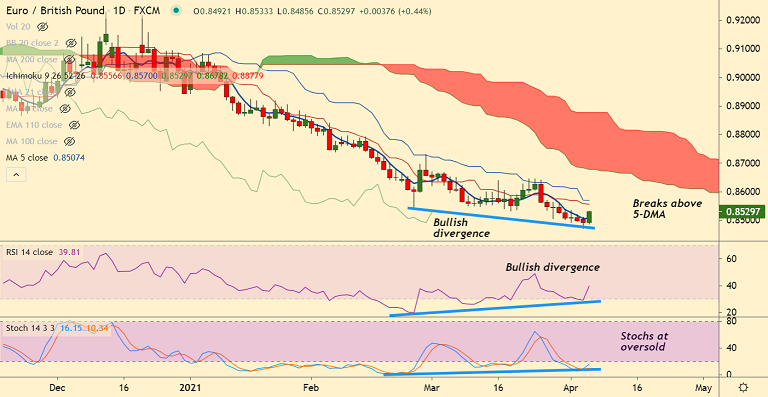

EUR/GBP chart - Trading View

Technical Analysis: Bias Neutral

- EUR/GBP was trading 0.60% higher on the day at 0.8543 at around 09:30 GMT

- Price action has broken above 5-DMA and is testing 200 SMA on the hourly charts

- RSI has rollover from oversold levels and Stochs are at oversold

- Bullish divergence on Stochs and RSI keeps scope for further upside

Support levels - 0.8509 (5-DMA), 0.8465 (110-month EMA), 0.8484 (Lower BB)

Resistance levels - 0.8560 (21-EMA), 0.86, 0.8627 (Upper BB)

Summary: EUR/GBP saw a strong intraday rally as reports that the EU may hit vaccination target earlier than projected boosted the common currency. On the data front, a stronger Eurozone Sentix investor confidence index, which jumped to 13.1 for April, further underpinned the euro. EUR/GBP finds stiff resistance at 21-EMA at 0.8560. Watch out for decisive break above for upside continuation.