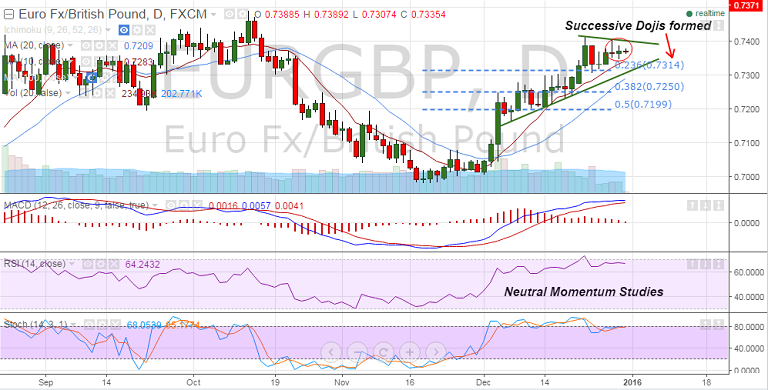

EUR/GBP has bounced back from strong trendline resistance at 0.7408 in Tuesday's trade, successive Dojis at highs raises scope for some downside.

- However, despite recent consolidation, 0.7342 rising 10 DMA has held, close below would target pivotal rising 0.7289 20 DMA.

- Momentum studies are neutral, 5-DMA at 0.7363 is immediate support on the downside ahead of 0.7314 (23.6 % Fib of 0.6981-0.7416 rise).

- Immediate resistance is seen at 0.7381 (Dec 28 high) and then at 0.7388 (rising trendline).

- Buying dips remains favored, but for a trading purpose it is good to sell rallies around 0.7380 levels, SL: 0.7420, TP1: 0.7320, TP2: 0.7290

Resistance Levels:

R1: 0.7381 (Dec 28 high)

R2: 0.7388 (rising trendline)

R3: 0.7408 (Daily High Dec 29)

Support Levels:

S1: 0.7363 (5-DMA)

S2: 0.7342 (10 DMA)

S3: 0.7318 (Daily Low Dec 24)