EUR/GBP chart - Trading View

EUR/GBP was trading 0.30% higher on the day at 0.8514 at around 10:45 GMT, extending previous session's gains.

Sterling was pounded lower after data released Thursday showed UK Industrial and Manufacturing Production printed lower than expected.

On the other side, upbeat Eurozone Trade Balance for June keeps the single currency supported.

Data released on Friday showed Eurozone non-seasonally adjusted Trade Balance for June stood at €18.1B, beating forecasts at €12B and compared to €7.5B in the previous month.

Eurozone seasonally adjusted Trade Balance for June was also better than consensus, stood at €12.4B (forecasts €9.3B and prior €13.8B).

Germany’s July Wholesale Price Index for July however, missed expectations and was at 11.3% YoY and 1.1% MoM compared to 11.6% and 1.3% expected respectively.

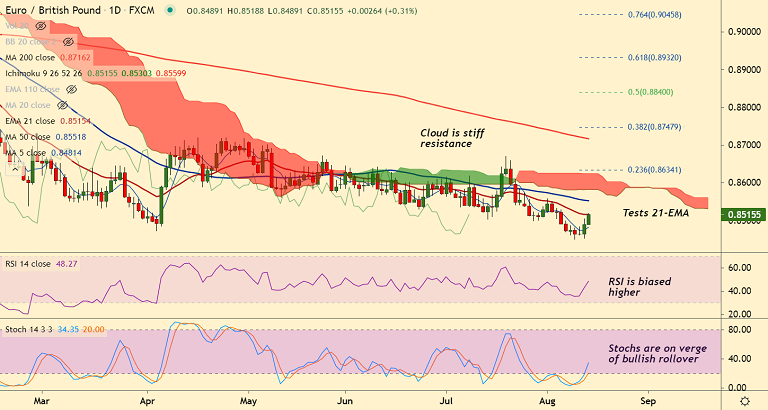

EUR/GBP trades with a major bearish bias, but oversold oscillators which are on verge of bullish rollover may see some upside.

The pair is testing 21-EMA resistance at 0.8515, decisive break above will see gains till 55-EMA at 0.8551. Bearish invalidation only above daily cloud.