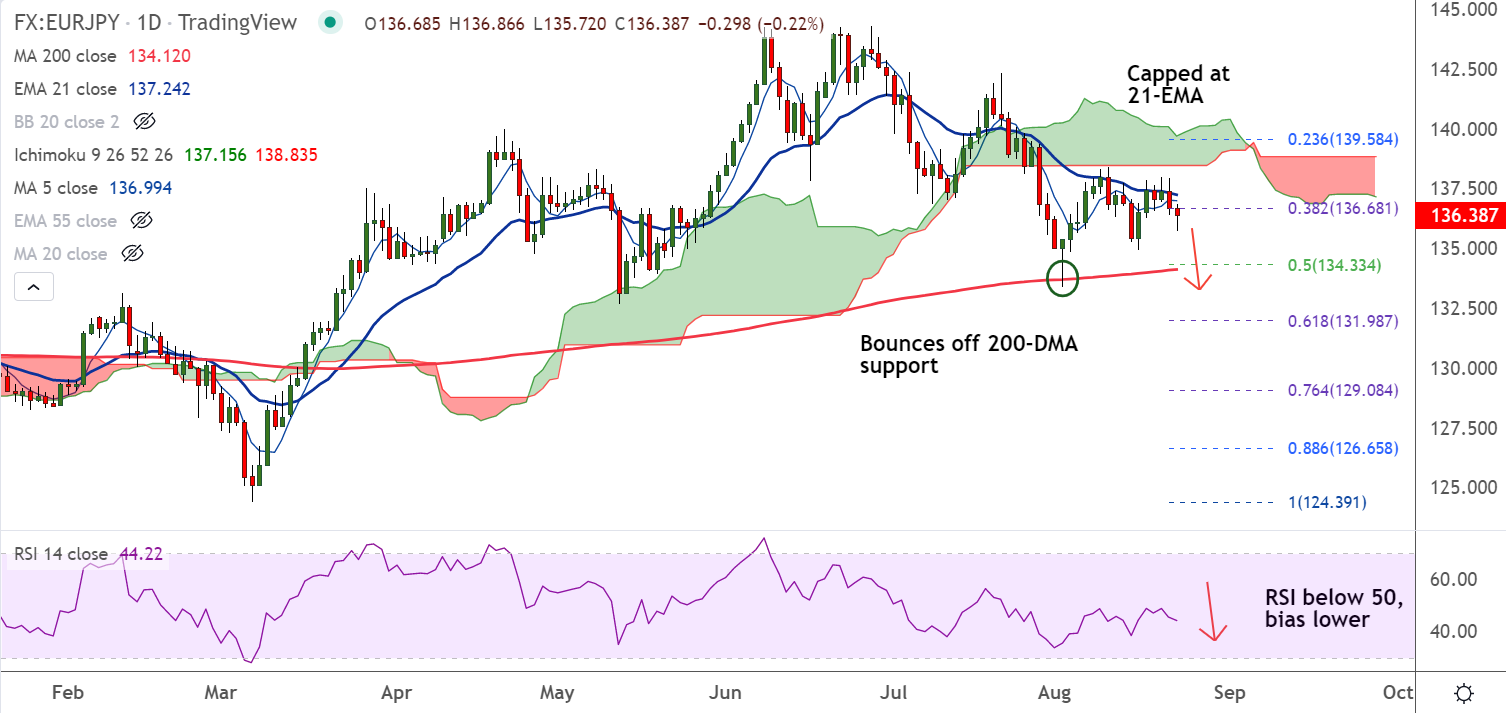

Chart - Courtesy Trading View

Technical Analysis:

- EUR/JPY was trading 0.22% lower on the day at 136.37 at around 10:05 GMT

- The pair is extending weakness after rejection at 21-EMA resistance

- Price action is below 200H MA and GMMA indicator shows major and minor trend are bearish on the intraday charts

- The pair is trading below daily cloud and Chikou span is biased lower

Major Support Levels:

S1: 134.88 (Lower BB)

S2: 134.11 (200-DMA)

Major Resistance Levels:

R1: 136.99 (5-DMA)

R2: 137.23 (21-EMA)

Summary: EUR/JPY is trading with a bearish bias. Scope for test of 200-DMA. Bearish invalidation only above 21-EMA.