Chart - Courtesy Trading View

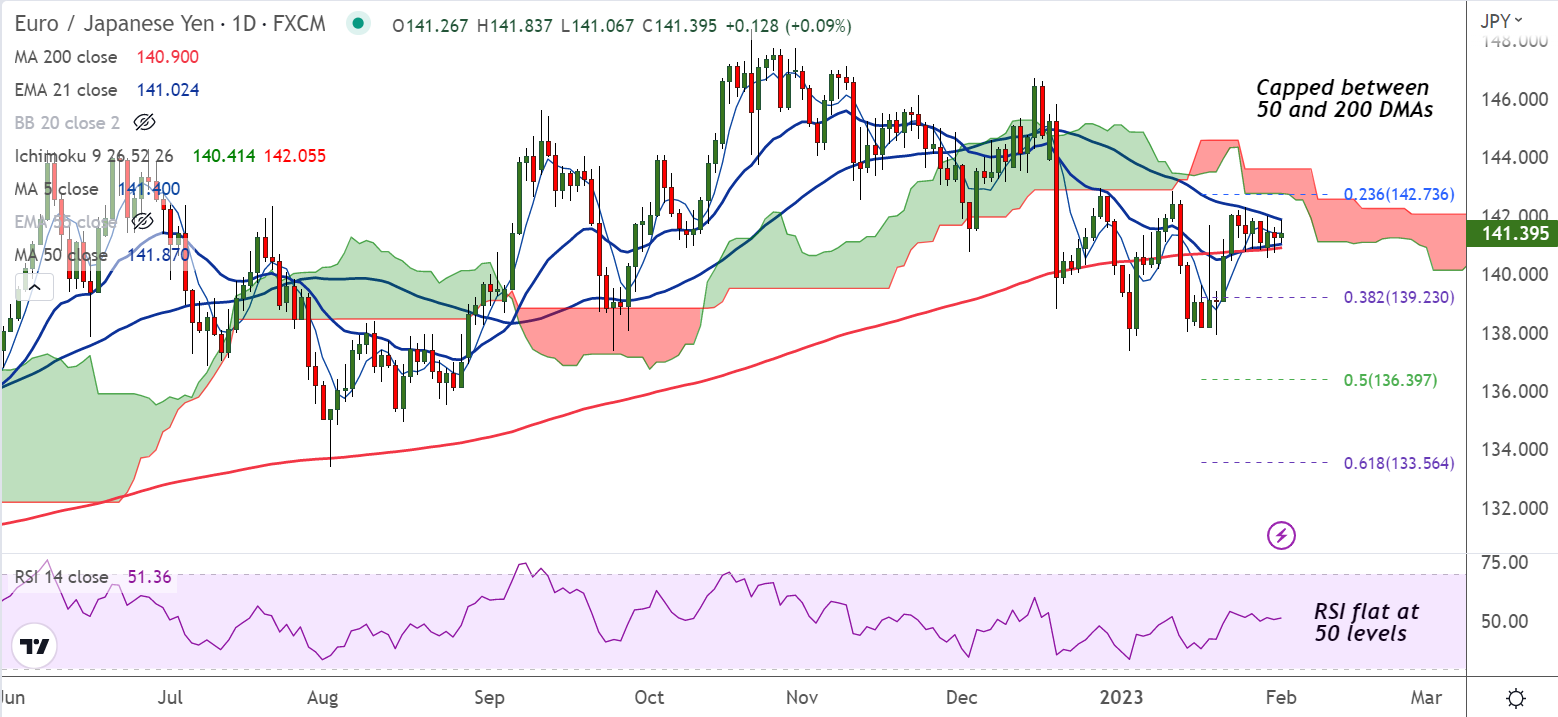

EUR/JPY was trading 0.08% higher on the day at 141.38 at around 10:20 GMT, bias is neutral.

Price action remains capped between 50 and 200 DMAs, decisive breakout will provide clear directional bias.

Data released by the Eurostat earlier on Wednesday showed euro area Harmonised Index of Consumer Prices (HICP), declined to 8.5% on a yearly basis in January from 9.2% in December, below the market expectation of 9%.

The Core HICP declined by 0.8% on a monthly basis in January but the annual rate remained unchanged at 5.2%, compared to analysts' estimate of 5.1%.

Technical indicators do not provide clear direction. GMMA indicator shows major and minor trend are neutral.

Support levels - 140.90 (200-DMA), 140.68 (20-DMA)

Resistance levels - 141.74 (55-EMA), 143.14 (Upper BB)

Summary: EUR/JPY trades with a neutral bias, trapped between 50 and 200 DMA. Watch out for decisive breakout for further direction.