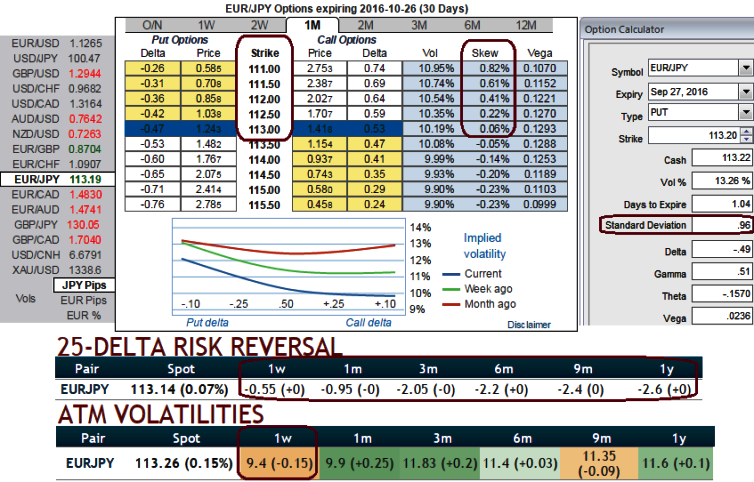

EURJPY IVs of 1w tenors have reduced to below 9.5% after BOJ’s shift in its monetary policy stance, while risk reversals still indicate the bearish hedging sentiments in the FX OTC markets.

From these risk reversal numbers, the hedging framework can individually be tailored, structured to mitigate the risk associated with the FX exposures. You can define:

The risk reversal allows for a customized hedging solution, tailored to your risk and hedging profile. Risk reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Moreover, the IVs of 1m tenors have been positively skewed on OTM put strikes that signify the sentiments of hedging for the bearish pressures in this pair. On the other hand, the standard deviation of current ATM puts are at 0.96. We see IVs have fallen in a range that is in sync with standard deviation, for an instance, synthesizing IV skews (with spot rates) at strikes 112.50 are 0.22%, even if calculate forward rates factoring this skewness it remains well within standard deviation.

Thus, we urge you to be mindful as to how to factor it into your trading strategy you are unlikely to win long term.

Standard deviation is logical, easy to comprehend and would help you time entries better and define targets for trades, as well as spotting important trend reversals and indicates the volatility of price in any currency. In essence, standard deviation measures how widely values are dispersed from the mean or average.

Fundamentally, amid the apprehensions on perimeters of the policy arsenal at the ECB and rising euro-centric risks, we recommend maintaining shorts positions in EURJPY for medium term hedging but by capitalizing on every short-term upswing, preferably via options.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes