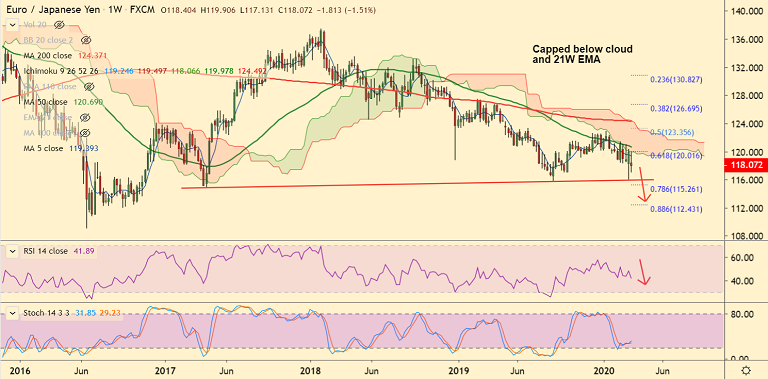

EUR/JPY chart - Trading View

EUR/JPY has failed to sustain Friday's massive gains. Upside has been capped at 200-DMA which is stiff resistance (currently at 120.10).

After a few extremely volatile sessions, the pair is currently trading 0.30% lower on the day at 118.03 at around 10:40 GMT.

Back-to-back long-legged Dojis on the daily charts suggests selling pressure and highs.

Major and minor trend for the pair are bearish as evidenced by the downward sloping moving averages in the GMMA indicator.

Price action is capped below weekly cloud and 21W EMA (currently at 120.057). Momentum is bearish and RSI is below 50.

Resumption of downside likely. Next bear target lies at 116 (trendline) ahead of 78.6% Fib at 115.26.

Support levels - 116 (trendline), 115.26 (78.6% Fib)

Resistance levels - 119.02 (21-EMA), 120.10 (200-DMA)

Recommendation: Good to stay short on upticks around 118.20-118.60, SL: 120.00, TP: 117.70/ 117/ 116.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields