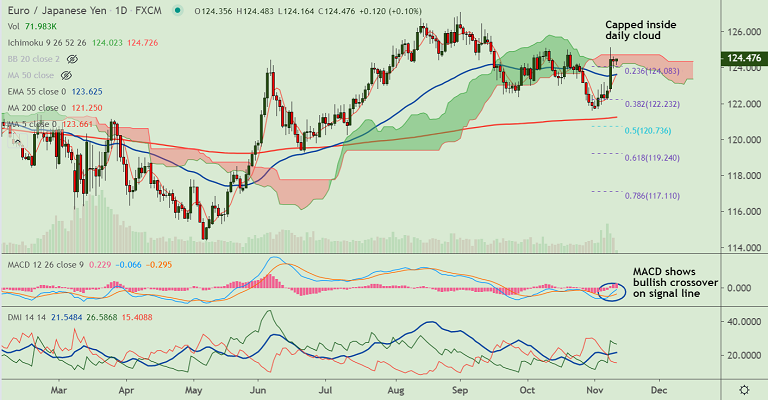

EUR/JPY chart - Trading View

Technical Analysis: Bias Bullish

- EUR/JPY was extending range trade for the second straight session

- Price action remains capped within the daily cloud and break above will provide upside boost

- MACD and ADX support upside in the pair and volatility is rising as evidenced by widening Bollinger bands

- Oscillators are biased higher, price action is above major moving averages, RSI on the daily and weekly charts is above 50 mark

Support levels - 123.62 (nearly converged 5-DMA and 55-EMA), 123.22 (38.2% Fib), 123.09 (110-EMA)

Resistance levels - 125.18 (200W MA), 125.95 (50% Fib), 126.30 (Trendline)

Summary: EUR/JPY trades with a bullish bias. The pair finds stiff resistance at 200W MA at 125.18. Breakout above cloud and 200W MA will propel the pair higher. Failure to break above cloud and retrace below 55-EMA will negate any bullish bias.