You want to be short in EURJPY but wouldn't like to have your face ripped off by an upgrade or early earnings? This debit put spreads is a way to take a slightly bearish bet that EURJPY will decline moderately.

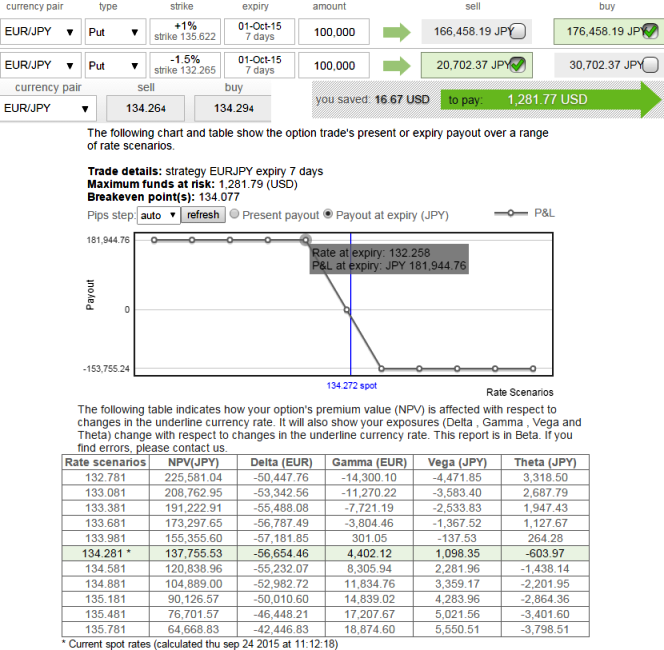

The current spot FX is trading at 134.227, we expect dips extending up to 132.522 levels in near terms. Unlike a simple naked put, put spreads have a short option at a lower strike that caps your reward but also reduces the net cost of the trade. So, the recommendation is buy 5D +1% ITM put while selling 3D-1.5% OTM put simultaneously.

You want to take this trade if you think this pair can go lower, but not crash below 132.265 (the OTM shorts). Caution If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

An overlooked part about bear put spreads is that you can use the option skew to your advantage.

Simply put, the option skew exists because investors are willing to pay more (on a relative basis) to buy protection against extreme downside rather than moderate downside. IV is higher on OTM strikes because investor pays for disastrous hedging.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

FxWirePro: EUR/JPY debit put spread for hedging – why skew is better for BPS

Thursday, September 24, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular