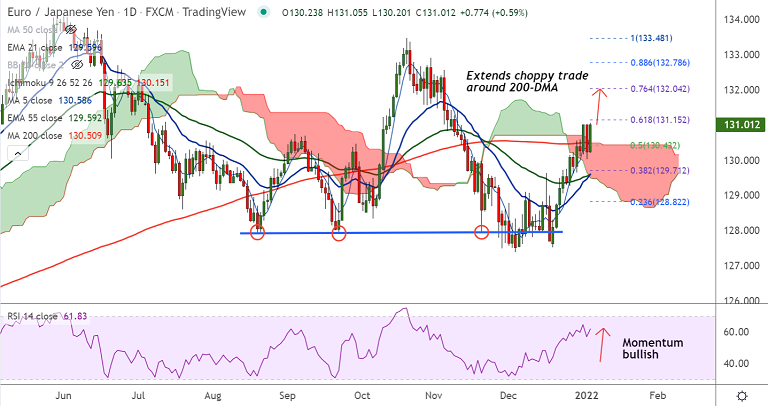

Chart - Courtesy Trading View

EUR/JPY was trading 0.50% higher on the day at 130.89 at around 11:00 GMT, outlook remains bullish.

Data released earlier on Tuesday showed German Retail Sales expanded at a monthly 0.6% in November and contracted 0.2% on an annual basis.

Further, German Unemployment Change showed a drop by 23K people in December and the jobless rate ticked lower to 5.2% in the same period.

Technical studies show bias is bullish. Momentum is bullish, volatility is high, price action is above major moving averages.

The pair is extending choppy trade around 200-DMA, decisive breakout above to see further gains.

Daily cloud offers strong support. Bullish invalidation only on break below. Bullish continuation will see test of 61.8% Fib at 131.15.