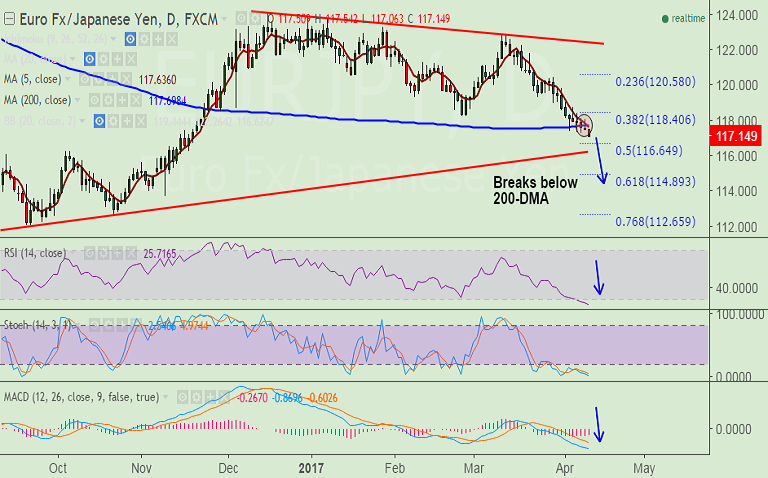

- EUR/JPY has broken below 200-DMA at 117.69 which is now major resistance on the upside.

- With just two weeks to go for French election, the EUR remains under pressure.

- Focus remains on the OAT-Bund yield spread ahead of the French elections.

- Data wise we have Eurozone industrial production data and German Zew survey indices which may not have much influence.

- IMM data for the week ended 04 April showed leveraged funds’ net short JPY positions continued to fall for the second consecutive week.

- Technical studies are bearish, the single currency remains weak, after Draghi squashed rate rise hopes last week.

- Support levels - 117, 116.65 (50% Fib retrace of 109.20 to 124.09 rally), 116.25 (Nov 17 low and trendline)

- Resistance levels - 117.69 (200-DMA), 118.40 (38.2% Fib retrace of 109.20 to 124.09 rally), 118.79 (Apr 5 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-EUR-JPY-hovers-around-200-DMA-good-to-go-short-on-close-below-11750-634780) is progressing well.

Recommendation: Hold for targets.