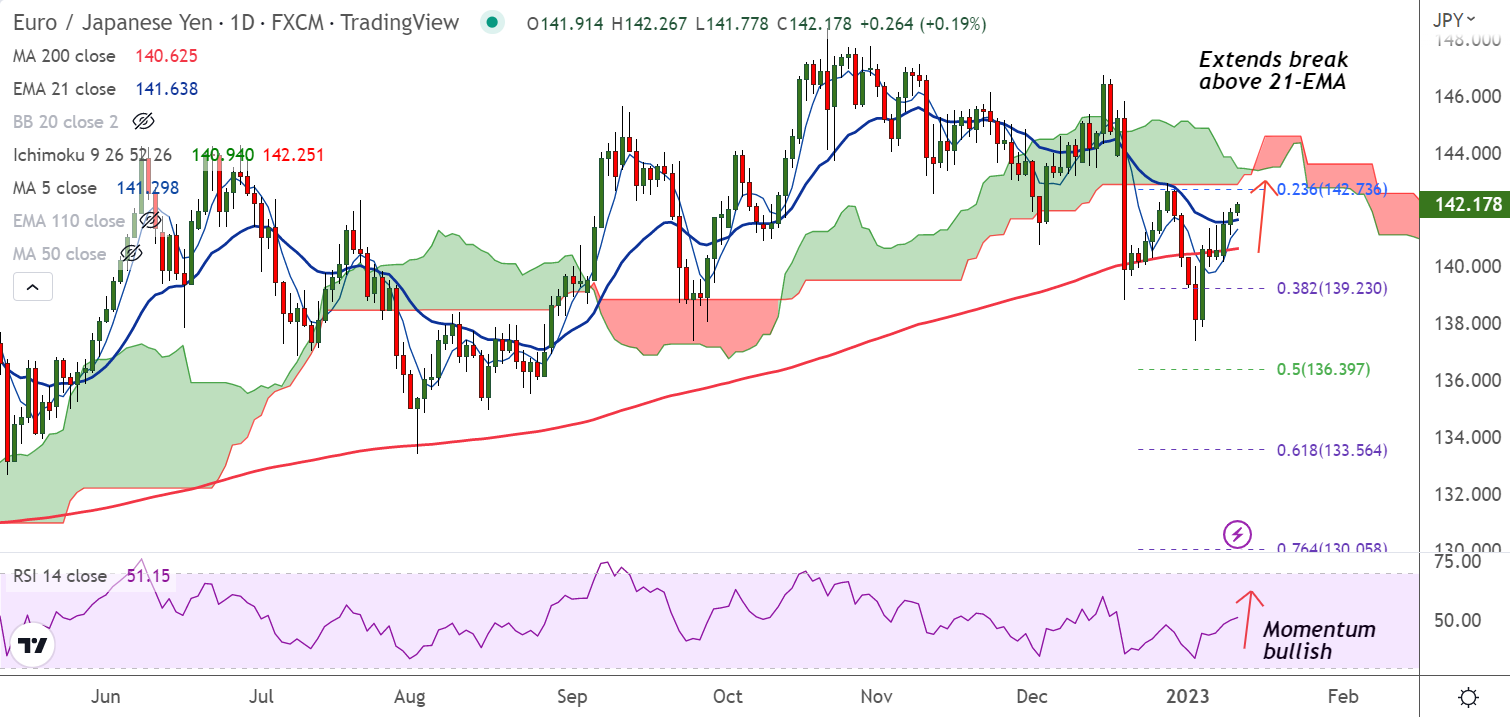

Chart - Courtesy Trading View

EUR/JPY was trading 0.19% higher on the day at 142.18 at around 04:20 GMT, extends break above 21-EMA.

The pair is extending bullish streak for the fourth consecutive session, outlook remains bullish.

Price action is extending break above 21-EMA, scope for further upside. Technical indicators are turning bullish.

MACD confirms bullish crossover on signal line, Chikou span is biased higher. Momentum has turned bullish, Stochs and RSI are biased higher.

Yen fails to cheer upbeat signals from Japanese policymakers. Japan’s Chief Cabinet Secretary Hirokazu Matsuno praised Japanese companies’ policies for wage hikes.

World Bank’s grim economic forecasts join a cautious mood ahead of Thursday’s US inflation data to challenge sentiment.

Support levels - 141.64 (21-EMA), 141.29 (5-DMA)

Resistance levels - 142.55 (55-EMA), 142.90 (20-week MA)

Summary: EUR/JPY poised for further upside. Scope for test of daily cloud at 142.88. Bullish invalidation only below 200-DMA.