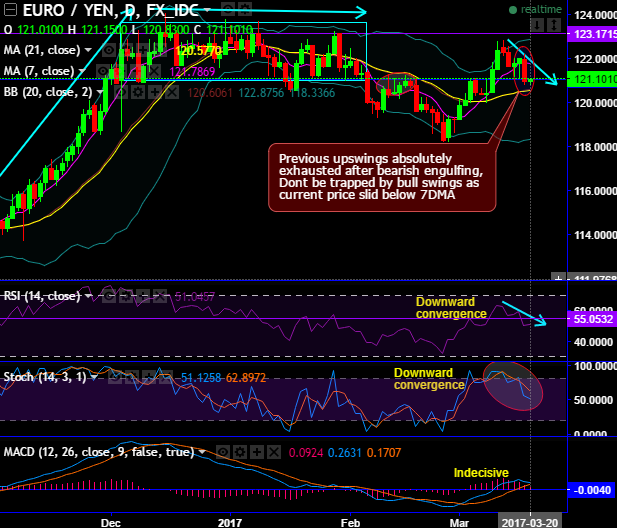

Please be noted that bearish engulfing candle pattern occurred at 121.0180 levels on last Friday’s candle, where we see the current prices have broken below strong support at 121.0887 levels.

As the current prices slid below 7DMA and 121.0887 levels last week, today again bulls are attempting to hover around this support level.

Consequently, the recent upswings are absolutely exhausted after the above mentioned bearish candle pattern.

On a broader perspective, after inverse saucer on EURJPY signals weakness of the major trend. For now, adjoining handle pattern is now on cards as interim bulls seem to be absolutely exhausted below 21EMAs (refer monthly charts).

As stated in our recent technical write up on this pair, rallies have extended upto 120.8326 levels or 21-EMA on monthly plotting. As a result, the bear swings seem to be gaining selling interest at this juncture that is where attempts of price drops considerable.

Subsequently, on daily plotting, RSI (14) has been converging below 52 levels (while articulating) to the declines that signal the strength in downtrend, while stochastic curves are also (at 50 levels) evidencing %D crossover that signal strong selling momentum but this has been little indecisive on monthly terms although bearish biasness is seen at this level.

Thus, leading indicators on daily terms signal intensified selling momentum, while MACD with bearish crossover indicates the extension of price declines.

Thereby, the 6 months of consolidation phase now seems to be deceptive and extension of dips seems most likely as lagging oscillators have been indecisive but slightly in bears favor.

Hence, we advise not to get perplexed with today’s upswings of EURJPY, the formation of adjoining handle pattern to inverse saucer still intact.

Trading tips:

Contemplating above technical reasoning, on hedging grounds we advocate shorting futures contract of mid-month or near month expiries to arrest potential slumps up to 120.5678, 118.0703, and 113.6590 levels also cannot be ruled out upon breach of 1st two targets.