- EUR/JPY retraced from 3-week lows at 129.12 and is currently trading at 129.45.

- The pair has closed a slight bearish gap and is currently up 0.08% on the day as markets focus on BoJ policy meeting.

- The central bank is expected to justify prolonging the current monetary easing policy this week.

- On the other side, the single currency remains dented after dovish ECB last week.

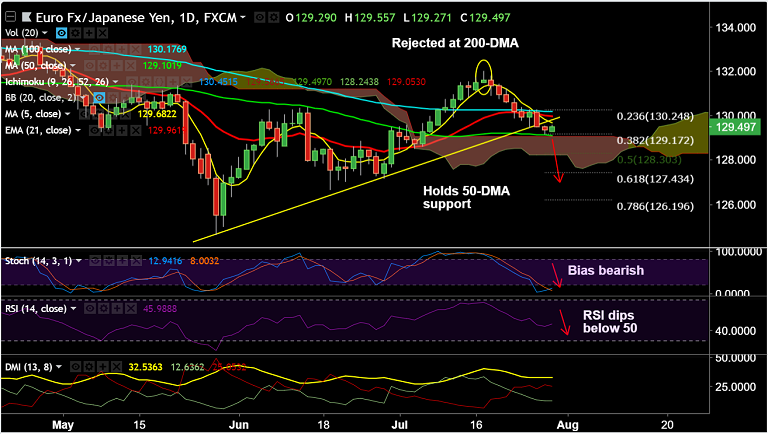

- Technical indicators on intraday charts support weakness. Stochs and RSI are biased lower and we see -ve DMI dominance.

- The pair is holding support at 50-DMA at 129.10, break below opens up further downside.

- Daily cloud also is strong support at 129.05. Break below will raise scope then for test of 61.8% Fib at 127.43.

- On the flipside, 21-EMA is strong resistance at 129.95. Decisive break above will see retest of 200-DMA. We see any bearish invalidation only above 200-DMA.

Support levels - 129.10 (50-DMA), 129.05 (cloud top), 128.50 (July 4 low)

Resistance levels - 129.68 (5-DMA), 129.96 (21-EMA), 130.17 (100-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-JPY-rejected-at-200-DMA-with-shooting-star-formation-break-below-100-DMA-opens-up-further-downside-1406704) has hit prescribed target levels.

Recommendation: Watch out for break below 50-DMA for further weakness.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -11.5519 (Neutral), while Hourly JPY Spot Index was at 37.4651 (Neutral) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.