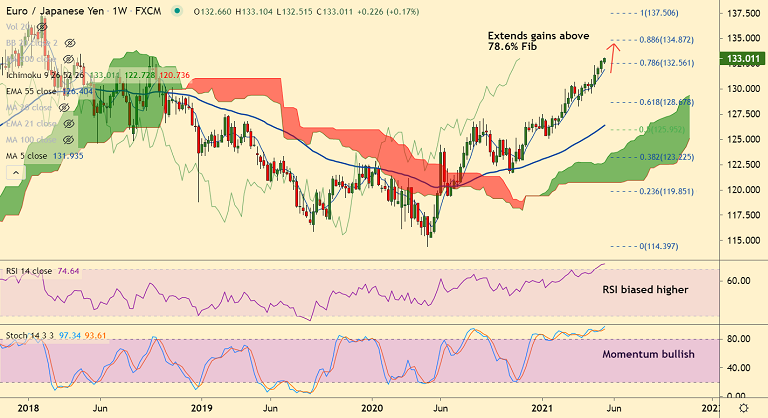

EUR/JPY chart - Trading View

Spot Analysis:

EUR/JPY was trading 0.32% higher on the day at 133.07 at around 10:25 GMT

Previous Week's High/Low: 132.95/ 132.51

Previous Session's High/Low: 132.84/ 131.64

Fundamental Overview:

Eurozone GDP contracts by 0.6% QoQ in Q1, matching -0.6% expected, the second estimate confirmed earlier on Tuesday.

On an annualized basis, the bloc’s GDP dropped by 1.8% in Q1 vs. -1.8% seen in the first reading while meeting -1.8% expectations.

Separately, Eurozone's employment fell by 0.3% and 2.1% on QOQ and YoY respectively in Q1 2021.

Meanwhile, the Union’s trade balance arrived at EUR13.0B in March vs. EUR23.1B last.

Technical Analysis:

- GMMA indicator shows major and minor trend are strongly bullish on daily and weekly charts

- Price action is above daily cloud and major moving averages

- Momentum studies support upside, Stochs and RSI are strongly bullish

- MACD and ADX also support gains

- Breakout above 200-month MA has opened upside

Major Support and Resistance Levels:

Support - 132.56 (78.6% Fib), 131.68 (21-EMA), 130.29 (200-month MA)

Resistance - 133.32 (Upper BB), 133.48 (Apr 2018 high), 134.87 (88.6% Fib)

Summary: EUR/JPY trades with a bullish bias. Scope for test of 88.6% Fib at 134.87. Bullish invalidation only on retrace below 200-month MA.