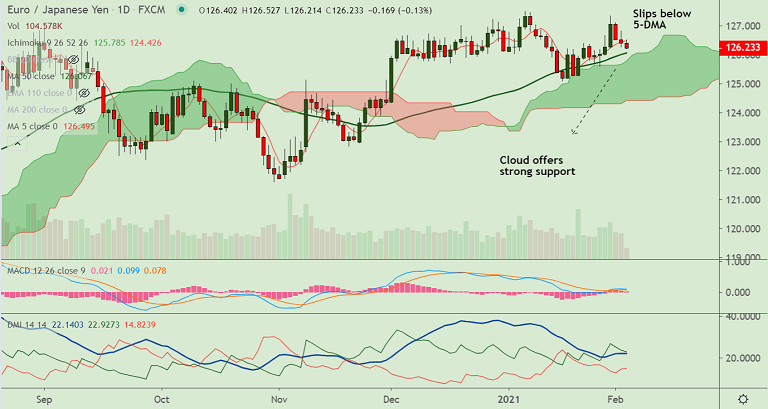

EUR/JPY chart - Trading View

EUR/JPY was extending weakness for the 3rd straight session, trades 0.11% lower at 126.26 at around 12:00 GMT.

The single currency remained under pressure after data released earlier on Wednesday showed final January’s Services PMI in both Germany and the broader Euroland remained in contraction territory.

Euro paid a little heed to the upbeat Eurozone inflation numbers which showed annual CPI at 0.9% in January, beating expectations of 0.5% and -0.3% previous.

The core figures came in at 1.4% in January when compared to 0.9% expectations and 0.2% recorded in December.

At the time of writing, the pair was trading below 5-DMA resistance and was on track to test 50-DMA at 126.06.

Major trend in the pair is bullish and daily cloud offers strong support. Breach at cloud support will change near-term dynamics.

Price action is consolidating break above 200W MA, resumption of upside will see test of 61.8% Fib at 128.67.