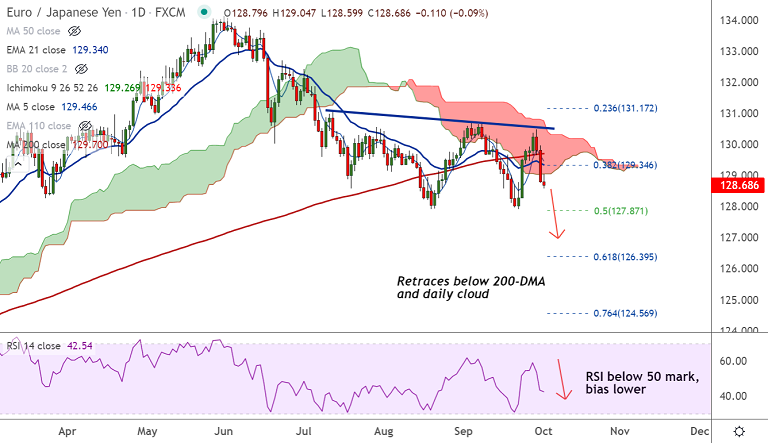

EUR/JPY chart - Trading View

EUR/JPY was trading 0.08% lower on the day at 128.67 at around 10:15 GMT.

The pair is extending weakness for the 3rd straight session, outlook is bearish.

Price action has slipped below 200-DMA and daily cloud, further downside likely.

Data published by Eurostat on Friday showed annualized Eurozone Consumer Price Index (CPI) rose by 3.4% in September, beating expectations of 3.3%, up from August’s reading of 3.0%.

The core figures arrived at 1.9% YoY in September when compared to 1.9% expectations and 1.6% booked last.

Technical bias for the pair is bearish, momentum indicators are biased lower and volatility is high, scope for further weakness.

Immediate support for the pair lies at 55-week EMA at 128.32. Break below will see next support at 127.93 (Double bottom).

On the flipside, immediate resistance lies at 129.04 (Cloud base). Bearish invalidation only above daily cloud.