Chart and candlestick pattern formed:

Bearish RSI divergence since March’2017 (refer monthly chart).

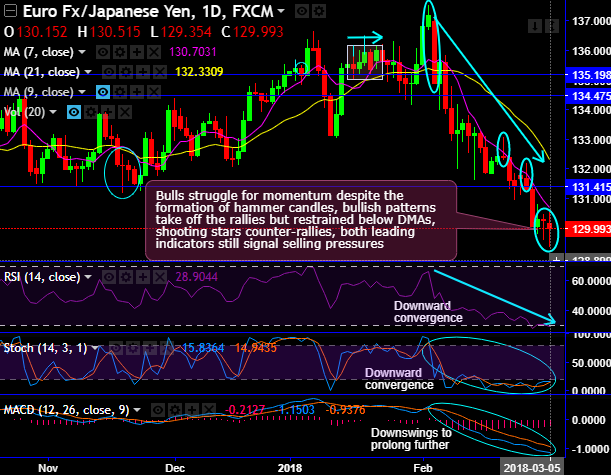

The bulls struggle for momentum despite the formations of the hammer (daily plotting).

Hammer pattern candles have occurred at 130.246 and 130.012 levels (daily plotting).

These bullish patterns have taken off the rallies ever since then but restrained below DMAs (daily plotting).

For now, the shooting stars counter-rallies, while both leading indicators still signal selling pressures.

The consolidation phase breaches 61.8% Fibonacci retracements but could not sustain, hanging man patterns appear at this stiff resistance zone to signal the previous uptrend seems to be exhausted. For now, the price has hit recent lows of 129.354 which is 7-months’ lows.

Consequently, these bearish patterns signal weakness as the leading oscillators indicate overbought pressures while lagging indicators are yet to confirm this bearish indication.

One can easily make out the RSI evidences the bearish divergence to the price rallies so far, while fast stochastic curves pop up with %D crossover to signal intensified selling momentum.

Momentum oscillators on both timeframes have been indecisive but pops up overbought pressures, whereas the trend indicators on major trend are still bulls' favor.

Trade tips: On trading perspective, it is advisable to buy tunnel spreads using upper strikes at 130.7054 and lower strikes at 129.354 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remains above lower strikes before the binary expiry duration.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 28 levels (which is bullish), while hourly JPY spot index was at 87 (highly bullish) while articulating at 11:09 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: