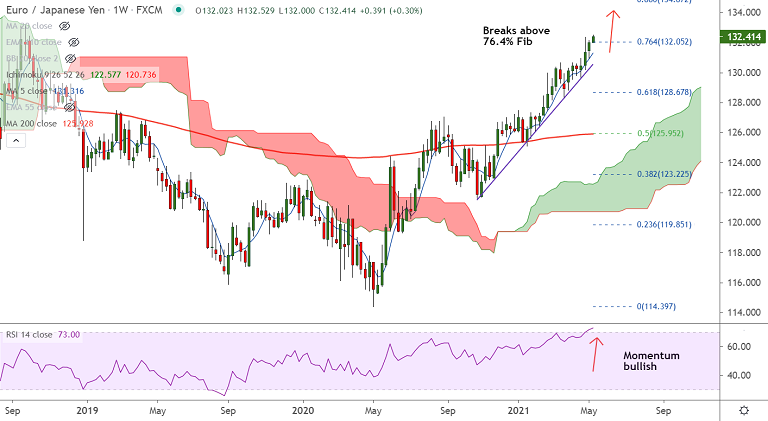

EUR/JPY chart - Trading View

EUR/JPY was trading 0.22% higher on the day at 132.31, slightly lower from session highs at 132.38.

The pair has started the week on a bullish note and price action has tested new 2 1/2 year highs.

Technical analysis supports upside in the pair. Momentum is bullish and volatility is high and rising.

GMMA indicator shows major and minor trend in the pair are strongly bullish. MACD and ADX also support upside in the pair.

Price action has broken above 76.4% Fib retracement at 132.05 and is extending break above 200-month MA.

Little resistance is seen for bulls till 88.6% Fib at 134.87. On the flipside, 5-DMA is immediate support at 131.66. Bullish invalidation likely below 200-month MA.