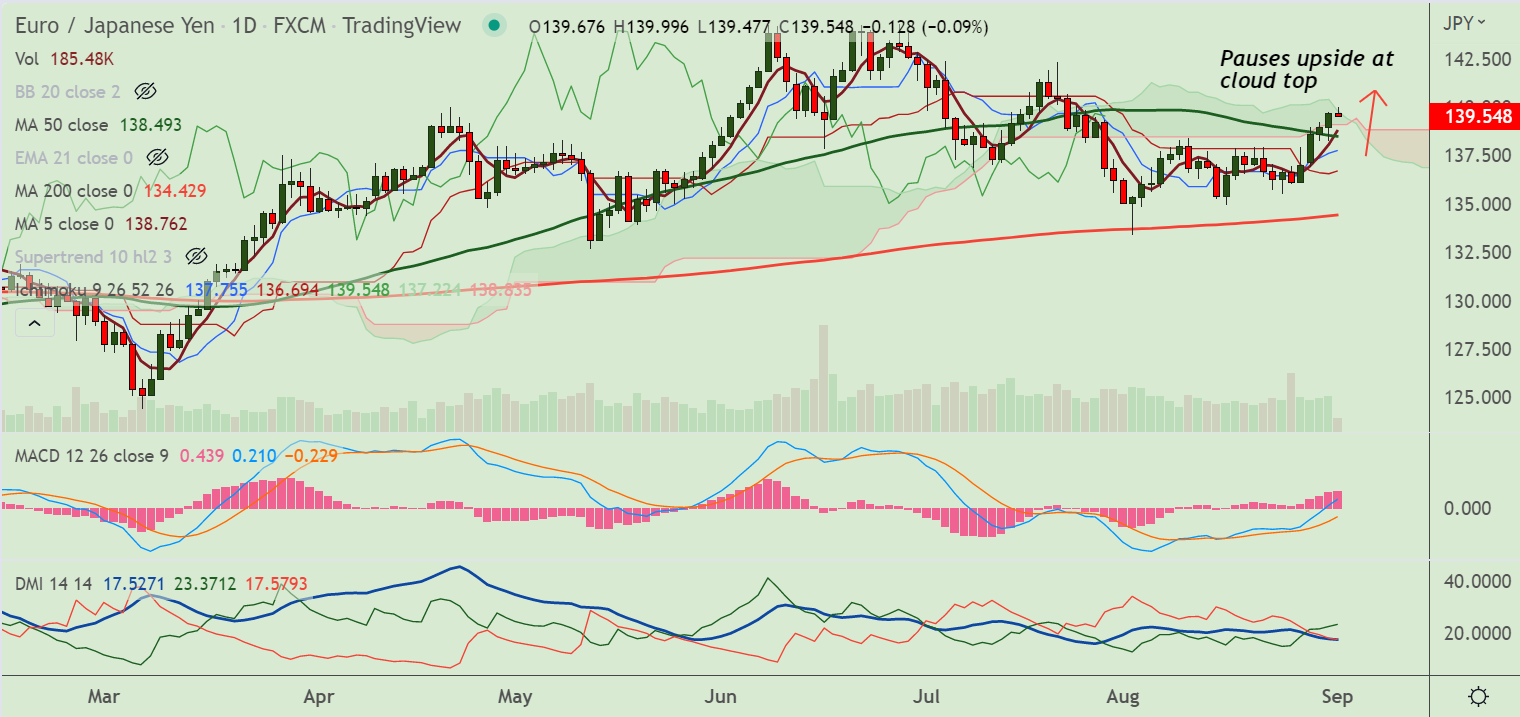

Chart - Courtesy Trading View

EUR/JPY was trading 0.06% lower on the day at 139.58 at around 07:10 GMT. The pair has snapped a four-day bullish streak, pauses shy of 140 handle.

Data released by Destatis on Thursday showed Germany's Retail Sales jumped by 1.9% MoM in July versus 0% expected and -1.6% previous.

On an annualized basis, the bloc’s Retail Sales came in at -2.6% in July versus -6.5% expected and an 8.8% slump recorded in June.

The single currency largely unimpressed and remains little changed on the upbeat German Retail Sales data.

Risk-negative headlines from China, Taiwan keep the yen supported and keep upside in the pair limited.

Volatility is high and momentum is bullish. Price action is pivotal at cloud top resistance. Decisive break above cloud will fuel further upside.

Support levels - 138.76 (5-DMA), 138.49 (50-DMA)

Resistance levels - 140.39 (Cloud top), 141

Summary: EUR/JPY pivotal at cloud top, decisive break above will fuel further gains.