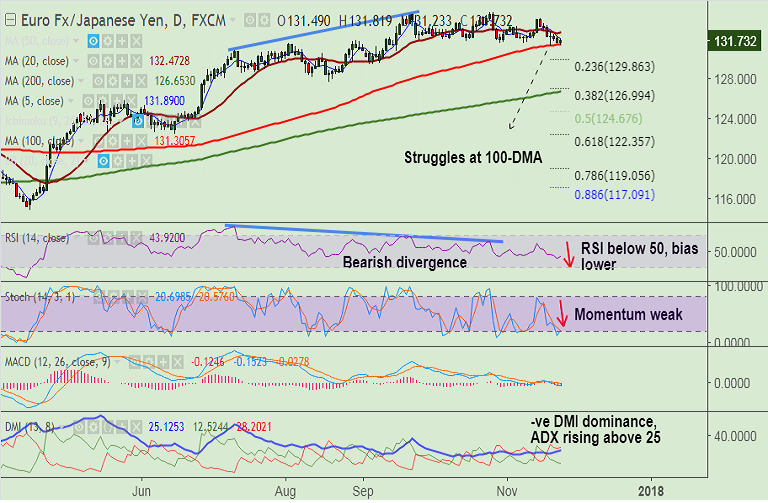

- EUR/JPY retraces brief dip below 100-DMA at 131.30, currently trades at 131.74 after hitting lows of 131.23.

- Technical studies are bearish, RSI below 50 levels and we see -ve DMI dominance which supports downside.

- Momentum indicators are also weak and MACD supports trend lower.

- Break below 100-DMA will accentuate weakness, scope then for test of 23.6% Fib at 129.86 ahead of 127.56 (Aug 18 low).

- On the flipside, immediate resistance lies at 5-DMA at 131.88 ahead of 132.47 (20-DMA).

Support levels - 131.30 (100-DMA), 131, 130.60 (Sept 15 low), 129.86 (23.6% Fib retrace of 114.85 to 134.50 rally)

Resistance levels - 131.88 (5-DMA), 132.47 (20-DMA), 133

Call update: We hold by our previous call (http://www.econotimes.com/FxWirePro-EUR-JPY-tests-100-DMA-support-at-13121-good-to-go-short-on-decisive-break-below-1017204).

Recommendation: Stay short below 100-DMA.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest