Chart - Courtesy Trading View

EUR/JPY was trading largely unchanged at 128.72 at around 10:00 GMT.

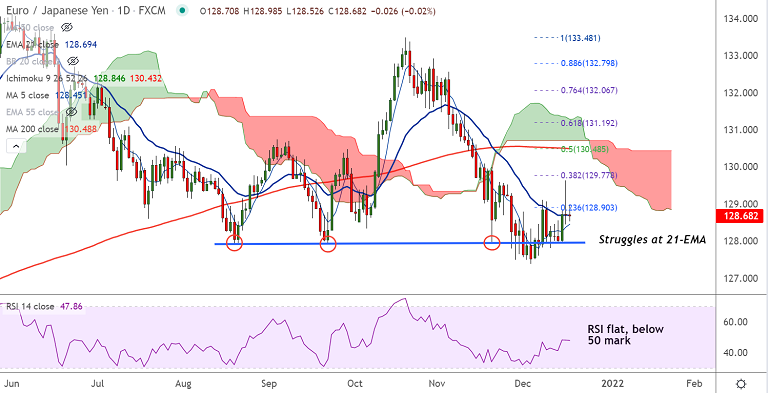

Back-to-back Doji formations on the daily charts raise scope for reversal in the pair.

Price action finds stiff resistance at 21-EMA, further upside only on decisive break above.

On the data front, German IFO survey disappointed on the downside, denting the single currency.

Data released earlier today showed headline German IFO Business Climate Index fell further to 94.7 in December versus 96.6 in the prior month and missing estimates of 95.3.

Meanwhile, the Current Economic Assessment came in at 96.9 points as compared to last month's 99.0 and 97.5 expected.

The IFO Expectations Index fell to 92.6 in December from the previous month’s 94.2 reading and worse than the market expectations of 93.5.

Technical analysis is biased lower, rejection at 21-EMA will raise scope for downside resumption. Scope for retest of major trendline support at 127.93.