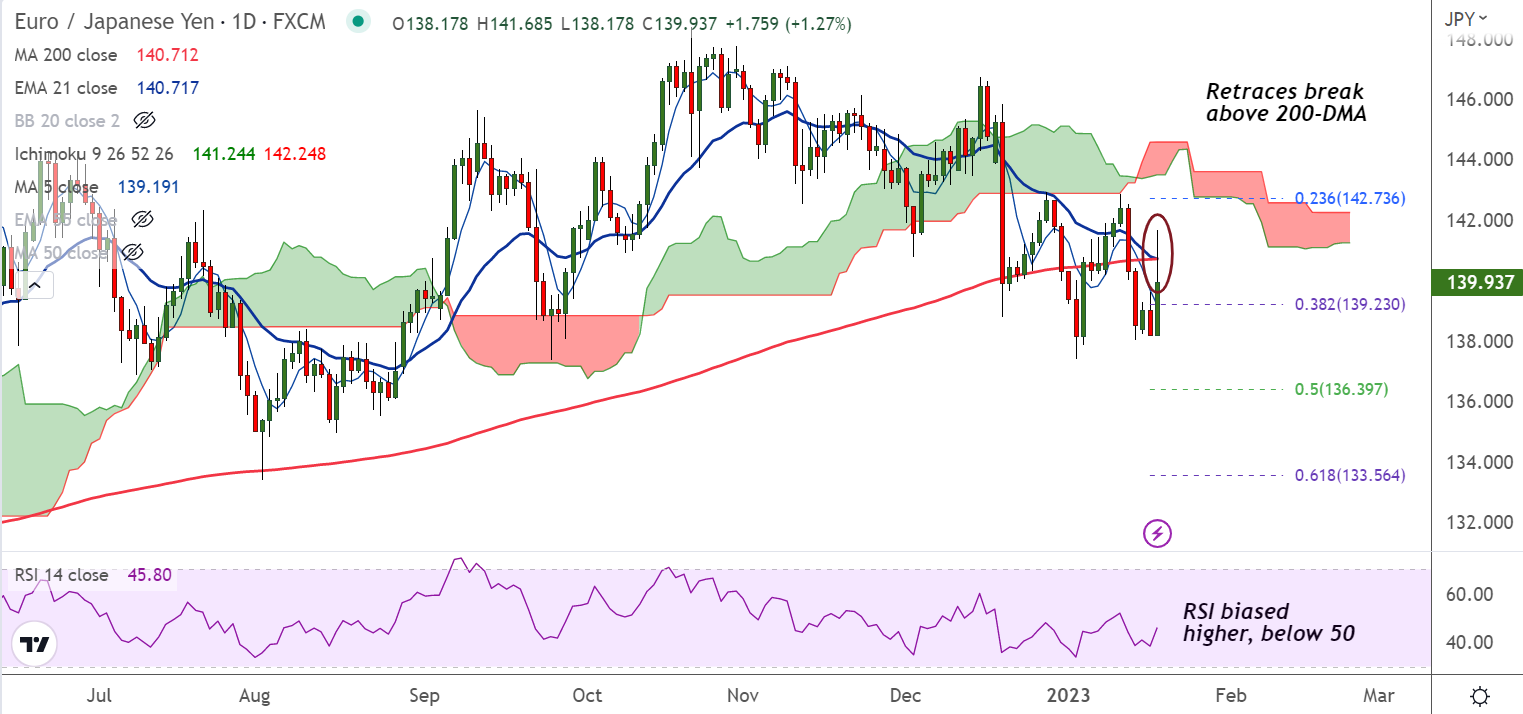

Chart - Courtesy Trading View

EUR/JPY has erased early gains and has slipped lower from session highs at 141.68 to trade at 139.81 at around 12:45 GMT.

The pair has failed to hold break above 200-DMA, slips below 200H MA, poised to extend weakness.

The Japanese yen was dumped across the board after the Bank of Japan (BoJ) unanimously decided to keep its yield curve controls in place.

The central bank maintained its short-term policy interest rate at negative 0.1%, and kept its long-term interest rate at 0%.

BoJ maintained ultra-low interest rates, including its 0.5% cap for the 10-year bond yield, defying market expectations it would phase out its massive stimulus programme.

The 10-year yield which had edged above the policy cap of 0.5% to an intraday high of 0.5100%, retreated sharply to 0.360% on Wednesday.

Focus now on Japan Nationwide consumer price index inflation data for December due Friday, expected to rise to 4% - twice the BOJ’s 2% annual target.

Technical bias for the pair is bearish. Decisive break above 200-DMA required for upside continuation.