We construct long put butterfly spread on this pair which offers restricted returns and limited risk, this strategy is advisable as we think that EURJPY will not rise or fall beyond above stated levels by expiration.

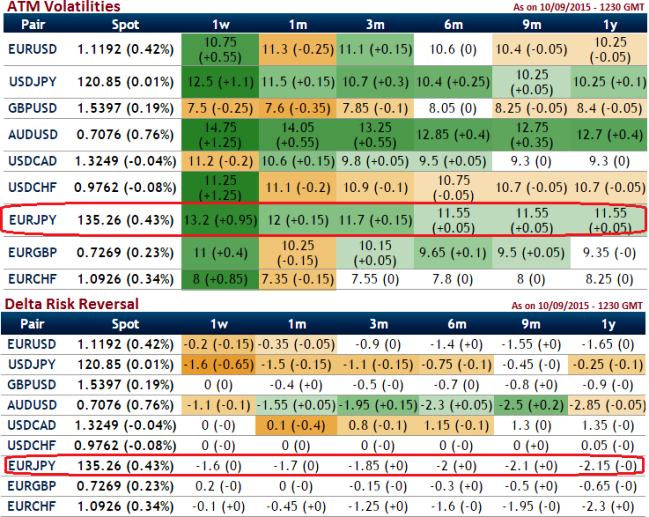

One can observe delta risk reversal for this pair is gradually turning into high negative values, this would mean that market sentiments for this pair have been negative for this pair, on the contrary even if it falls, it would not slip beyond 125.50 in near future and on upside it would not rise also beyond 140.50. Moreover, the pair is likely to perceive implied volatility close to 12-13% of ATM contracts, thus we recommend deploying short put ladder spreads which is suitable for prevailing significantly higher volatility times.

Why butterfly spread: Use this sideways strategy for capital gain, when you want to accomplish this a low cost and where maximum profits occur when the stock finishes at the middle strike at expiration.

So, here goes the execution this way:

Spot FX EURJPY is currently trading at 136.350. Buy 1M out of the money put and 1M in the money put simultaneously short 2 lots of at the money puts for a net debit.

Advantage: The benefit here is that you can realize a capital gain for little cost and capped risk.

Risk/Reward Profile: The risk is the net debit of the sold and bought options. The reward is the difference between adjacent strike prices minus the net debit.

FxWirePro: EUR/JPY to remain between 140.50-125.50 – butterfly spread for range bound trend

Friday, September 11, 2015 6:34 AM UTC

Editor's Picks

- Market Data

Most Popular