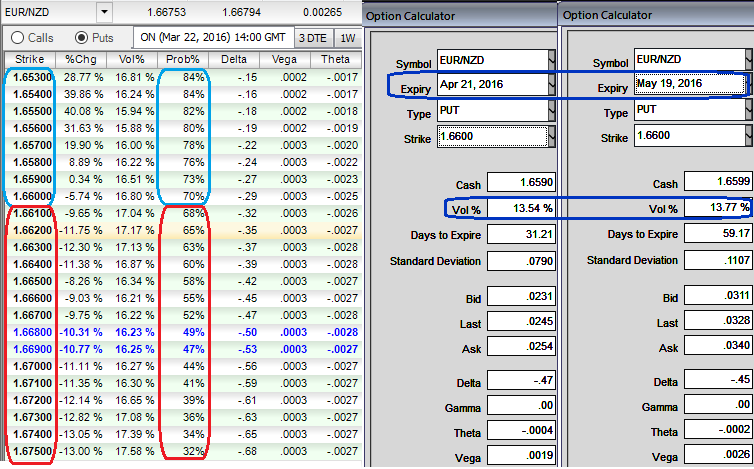

First and foremost, have a look at the EURNZD ATM IVs of 1 and 3 months tenor (at around 13.5-13.75%) which is why we would advocate the below strategy since more likelihood of underlying spot price swings more significantly and ATM instruments to mature in the money on expiration.

The strategy was chosen against shorts in call options which has to be out of the money. That is because of the probabilities of forward rates to expire in the money when you consider lower strikes (blue highlighted space).

Please glance on upper strikes (ex: add 0.9% to spot, around 1.6750), and their probabilities of expiring in the money are comparatively lesser than that of lower strikes..

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Spot ref:1.66

As we think ATM IVs of 1M expiries of this pair are at extremely higher side (13.54%) contemplating the sideway trend that is prolonging from last couple of days but now slightly to bearish bias, we eye on writing 1M (1%) OTM call.

If these vols and prices of ATM calls are quoted for standard moneyness levels for different time to expiry periods, then we reckon this as an opportunity for shorting such ATM calls considering the above technical reasoning.

How to execute:

Go long 1M At the money +0.51 delta Call, Go long 3M at the money -0.49 delta put and simultaneously, Short 1M (1%) out of the money call with positive theta or closer to zero.