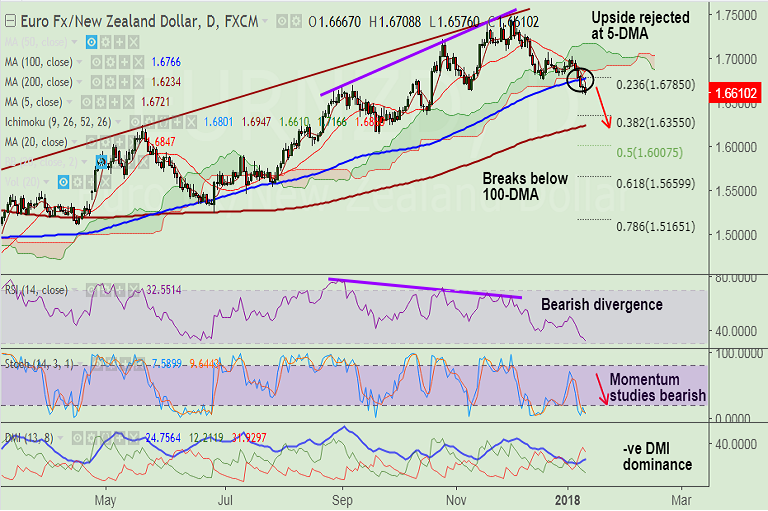

- EUR/NZD recovery attempts capped at 5-DMA at 1.6721, bias bearish.

- The pair has broken 100-DMA support at 1.6756, price action rages below daily cloud which is strong resistance.

- Technical studies support further downside, price has dipped below 23.6% Fib retracement levels.

- Bearish divergence on RSI seen. Further, RSI is sharply lower and below 50 levels.

- Momentum studies are heavily bearish. We see -ve DMI dominance and ADX supports downside.

- Next major support lies at 38.2% Fib retracement of 1.4534 to 1.7480 rally at 1.6355. Break there targets 200-DMA at 1.6234.

- On the flipside, retrace above 100-DMA could see minor upside. Breakout above cloud negates bearish bias.

Support levels - 1.6355 (38.2% Fib retracement of 1.4534 to 1.7480 rally), 1.6234 (200-DMA), 1.6007 (50% Fib)

Resistance levels - 1.6766 (100-DMA), 1.6723 (5-DMA), 1.6847 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-EUR-NZD-breaks-100-DMA-support-at-16756-good-to-short-rallies-1087540) has hit TP1.

Recommendation: Bias lower, stay short.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest