- EUR/NZD trades a narrow range, capped below 5-DMA at 1.6112.

- The common currency under pressure in light of last week’s ECB minutes. Markets also remain wary ahead of the Jackson Hole Symposium.

- ECB minutes showed that members were worried over the exchange rate appreciation and felt that accommodation was needed in either direction.

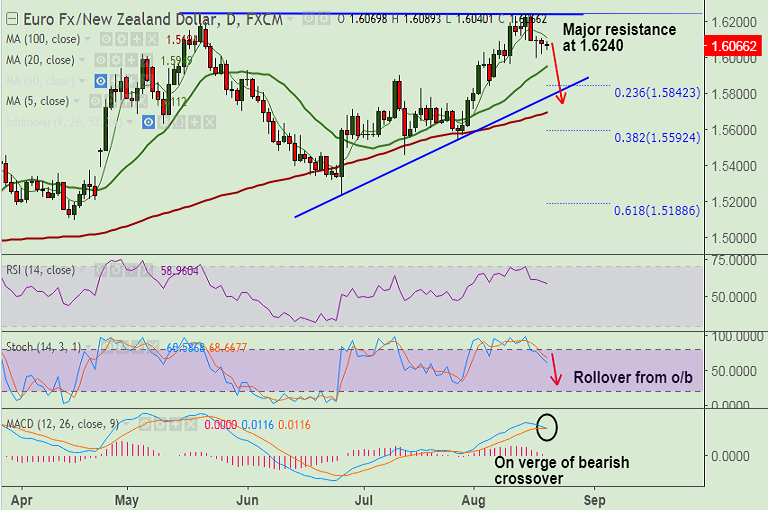

- Technical studies are bearish, we see scope for downside on the pair.

- Stochs have rolled over from overbought levels and MACD is on verge of a bearish crossover.

- 20-DMA at 1.5949 is immediate support. Breach there could see test of trendline at 1.5780.

- Bearish invalidation only on breakout above major trendline resistance at 1.6240.

Support levels - 1.60 (Aug 17 low), 1.5949 (20-DMA), 1.5842 (23.6% Fib retracement of 1.4534 to 1.6246 rally)

Resistance levels - 1.61, 1.6111 (5-DMA), 1.62, 1.6240 (trendline)

Call update: We had advised a short call on the pair (http://www.econotimes.com/FxWirePro-EUR-NZD-fails-at-major-trendline-resistance-at-16240-good-to-short-rallies-859630).

Recommendation: Bias lower. Stay short, hold for targets.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest