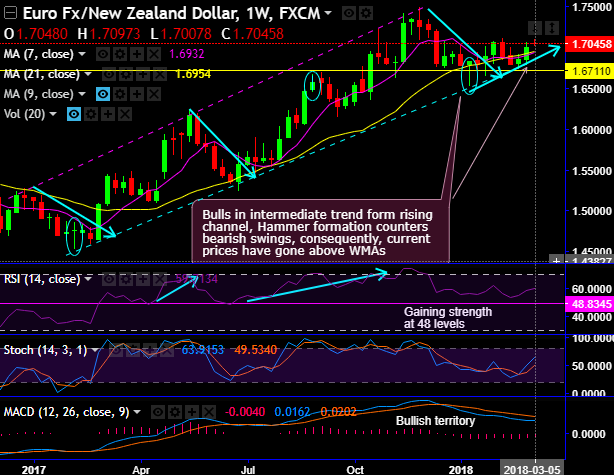

Chart pattern formed- Hammer pattern candlestick and rising channel (on weekly plotting) and double bottom pattern with bottom 1 at 1.3881 and 1.4534 levels (on monthly plotting).

The double bottom pattern helps in recognizing the higher probability opportunities to buy, or go "long."

Whereas the short-term trend has recently been testing the channel support at 1.6744 and 1.6794 levels, consequently, made a fake highs upto 1.7064 and 1.7026.

While RSI, so far, has been converging downwards along with the price drops that signals indecisiveness. Stochastic curves have also been indecisive but slightly bullish bias.

On a broader perspective, the major trend forms the double bottom pattern with bottom 1 at 1.3881 and bottom 2 at 1.4534 levels.

Stiff resistance is observed at 1.7106, 1.7285 and 1.8552 levels. It seems little puzzling whether this double bottom pattern can break-out these stiff resistance levels?

The current price spikes above EMAs with bullish crossovers, the sustenance above will extend rallies.

Both lagging indicators (EMAs and MACD) substantiate this bullish environment (refer monthly chart).

7EMA crosses over 21EMA levels which is bullish EMA crossover that indicates the uptrend extension further which is in line with the above stated bullish chart pattern.

Additionally, MACD has also shown bullish crossover which is again a substantiation to prolong the prevailing uptrend (refer monthly plotting).

Trade tips:

Contemplating lingering bullish environment coupled by the trend indicators, it is wise to bid for longs in the futures contracts of mid-month tenors to mitigate upside risks.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 57 levels (bullish), while hourly NZD spot index was at -52 (bearish) while articulating at 06:55 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: