- EUR/NZD has broken above 100-DMA and is trading 0.37% higher on the day at around 1.6929.

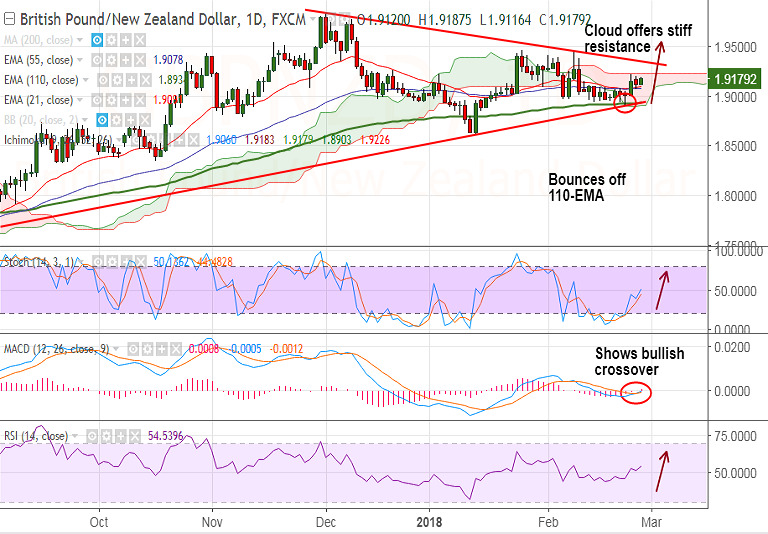

- Price action has taken support at daily cloud base and 110-EMA and edged higher.

- Technical indicators are turning positive. We see rollover of Stochs from oversold levels.

- RSI is biased higher, MACD is on verge of a bullish crossover on signal line.

- We see +ve DMI crossover on -ve DMI which raises scope for further upside.

- The pair finds stiff trendline resistance at 1.6975, breakout above could see further upside.

- On the flipside, break below 110-EMA could negate bullish bias.

Support levels - 1.6866 (55-EMA), 1.6842 (5-DMA), 1.6755 (110-EMA)

Resistance levels - 1.6975 (trendline resistance), 1.70 (cloud top), 1.71 (Feb 5 high)

Recommendation: Good to go long on break above 1.6975, SL: 1.6840, TP: 0.70/ 0.7065/ 0.71.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 134.03 (Bullish), while Hourly NZD Spot Index was at -86.6513 (Neutral) at 0840 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest