• EUR/NZD dipped on Monday as soured risk & safe-haven demand drove the pair lower.

• EUR/NZD recovery eroded as buoyant US rates, and stronger greenback sink weighed on the pair.

• The pair is currently approaching support at 1.6885 (50%fib). A break and daily close above will accelerate further gains towards 1.5800 level.

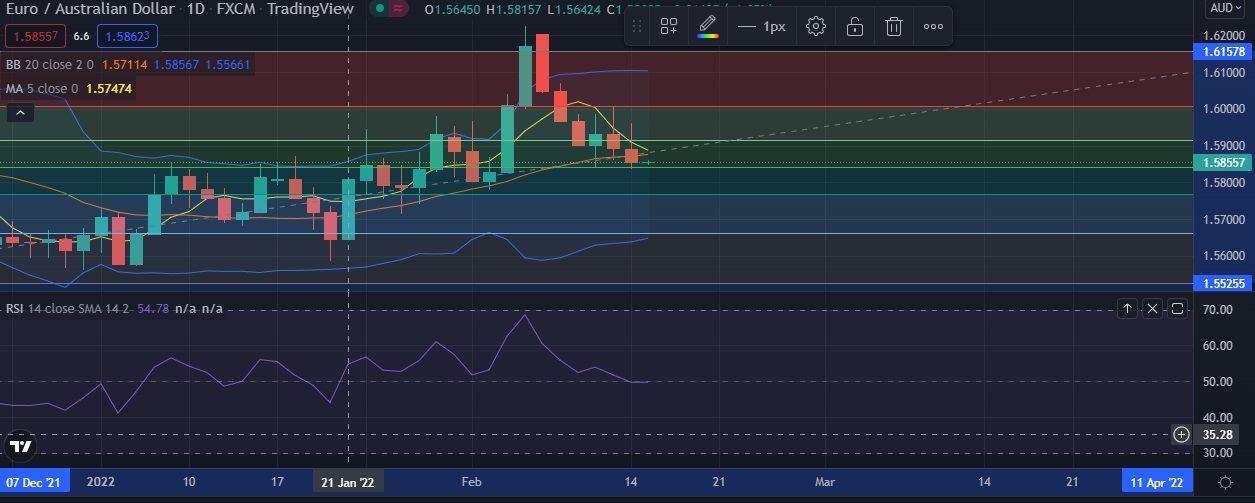

• Technical signals show the pair could gain more ground in the short-term as RSI is at 49 bearisg, daily momentum studies 5, 9 and 11 DMAs are trending up.

• Immediate resistance is located at 1.5885 (5DMA), any close above will push the pair towards 1.5915(23.6%fib).

• Strong support is seen at 1.5841(50%fib) and break below could take the pair towards 1.5768 (61.8% fib ).

Recommendation: Good to sell around 1.5850 with stop loss of 1.6000 and target price of 1.5790