- EUR/PLN extends downside for the 4th consecutive session.

- Polish Monetary Policy Council left interest rate unchanged at 1.5 percent Wednesday largely in line with expectations.

- The ECB earlier today maintained status-quo and left its main refinancing rate, deposit rate and marginal lending rates at 0.0%, -0.40% and 0.25% respectively.

- The euro edged slightly higher after ECB decision. Focus now on ECB President Mario Draghi's presser to determine the next leg of move for the shared currency.

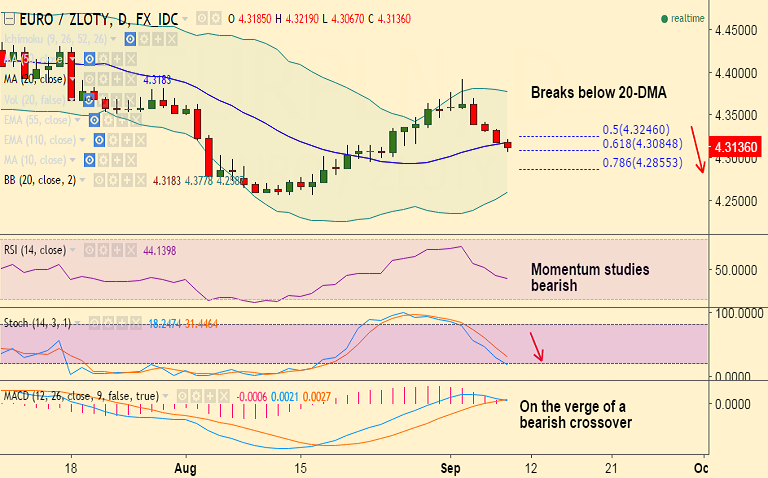

- The pair broke below 20-DMA support at 4.3183, scope for test of 78.6% Fib at 4.2855.

- Momentum studies are bearish, RSI is below the 50 mark, Stochs are biased south and MACD line is on the verge of a bearish crossover on signal line.

- Major support levels - 4.3085 (61.8% Fib), 4.2959 (Aug 23 low), 4.2855 (78.6% Fib)

- Major resistance levels - 4.3182 (20-DMA), 4.3246 (50% Fib), 4.3337 (5-DMA)

Recommendation: Good to go short on a decisive close below 20-DMA, SL: 4.3250, TP: 4.2959/ 4.2855/ 1.2730