We started 2020 with a positive, albeit shallow, forecast trajectory for EURUSD predicated on the economy doing better and this allowing the currency to appreciate from structurally very cheap levels assisted by a strong balance of payments position.

We cut the 1Y forecast last month from 1.14 to 1.11 as doubts mounted about the ability of the region to grow (it stagnated even before the virus outbreak). This month we go further and flip the forecast profile (the 1Q ahead forecast is raised from 1.08 to 1.11 but the 1Y is cut from 1.11 to 1.08). This leaves us with a negative trajectory for EURUSD for the first time in the last few years.

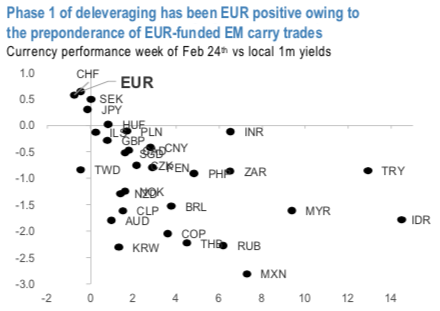

The timing of this downgrade might strike some as strange coming as it does on the heels of: 1) the Fed’s emergency rate cut (and the growing possibility that 85 the Fed could reach the zero-bound this year); and 2) the widespread deleveraging of EUR-funded carry

trades which has boosted EUR (refer 1st diagram).

We certainly acknowledge that the accelerated compression in front-end USD-EUR rate spreads could deter a certain range of short term capital outflows from EUR and hence, increase EUR’s overall balance of payments support (with Fed funds at zero, for instance, we doubt how attractive unhedged EUR-funding would be for US corporates). But as was apparent last year, EURUSD is not guaranteed to appreciate just because the Fed eases

policy.

OTC Outlook: EUR risk reversals have indicated the mounting hedging sentiments for the bearish risks as the fresh negative bids are observed (2nd diagram).

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer 3rd diagram).

Hence, considering all these factors, the below options strategies are advocated, we now wish to uphold the same strategies.

Options Strategy: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.1139 level). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: JPM & Saxo

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures