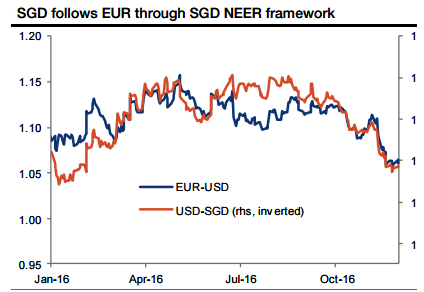

The SGD trades with a very strong correlation to the overall dollar cycle. It has been tightly linked to the EURUSD in the past year and the relationship should hold going forward given the SGD NEER framework (see above graph).

Low implied volatility within EM: The SGD has one of lowest implied vols in EM (3m implied volatility at 6.7%, against 10.0% for the EURUSD), making it relatively cheap to express a directional USD view through options. We expect overall EM currency volatility to increase in coming months alongside a stronger dollar.

Well, overall the dollar also remained largely cushioned by rising U.S. government bond yields and the dollar gaining traction towards (below 1.05 during Q1’2017) on account of three fundamental factors.

Firstly, worries that the OPEC-inspired higher oil price will generate additional US inflation and hence further Fed hikes, Secondly, the hopes of ramped up fiscal stimulus once Donald Trump becomes president, lastly, favorable economic data flashes.

As a result, we’re now seeing turbulence in euro’s OTC markets, the implied volatility of ATM contracts for 1w and near month expiries of EURUSD are spiking sky-rocketed at around 17.75% and 10.85% respectively which is the highest among G7 currency space.

While delta risk reversals flashing up negative numbers that signify the long-term robust bearish sentiments.

Tracking EUR to parity In Q1’17, we expect the EURUSD to break through the technical support at 1.05 and to reach parity (Trumped up changes). We previously provided trade recommendations for a significantly lower EURUSD.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025