- EUR/USD has pared its early loss and jumped slightly above previous high of 1.23453. The pair has shown drastic jump after ECB’S Lane says that there is no concern about level of Euro. The pair jumped till 1.23512 and is currently trading around 1.23366.

- US CPI data is to be released today at 12:30 GMT is major event for the day. It is expected to show 0.2% gain for the month of Feb.

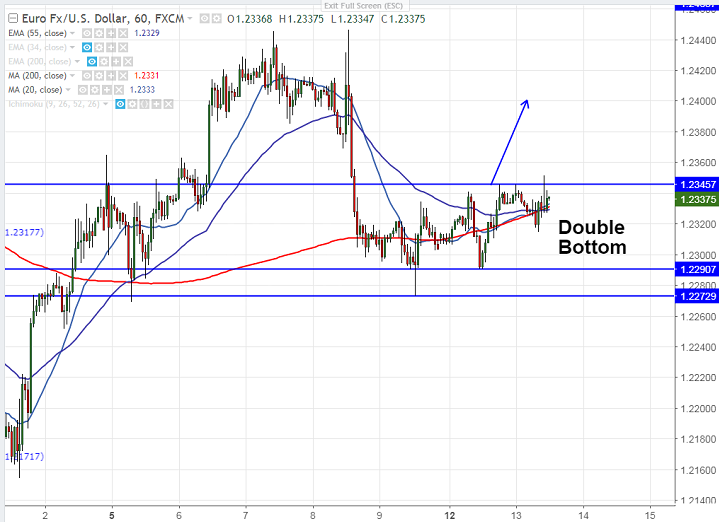

- The pair is facing near term resistance of 1.2360 and break above will take the pair till 1.2400/1.2435/1.2500. Bullish continuation can be seen above 1.2550.

- On the lower side, near term support is around 1.2270 and any violation below will drag the pair to next level till 1.2200/1.2165.

It is good to buy on dips around 1.2305-10 with SL around 1.2255 for the TP of 1.2400/1.2435.